Question: please show how to get to eacj answer Problem 2175 points): Congratulations, you have been hired as an analyst at the Procter and Gamble Co.

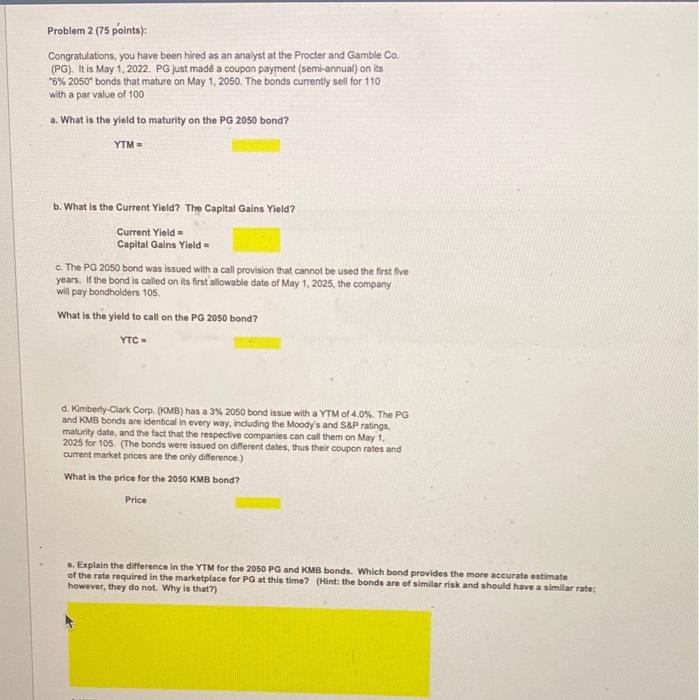

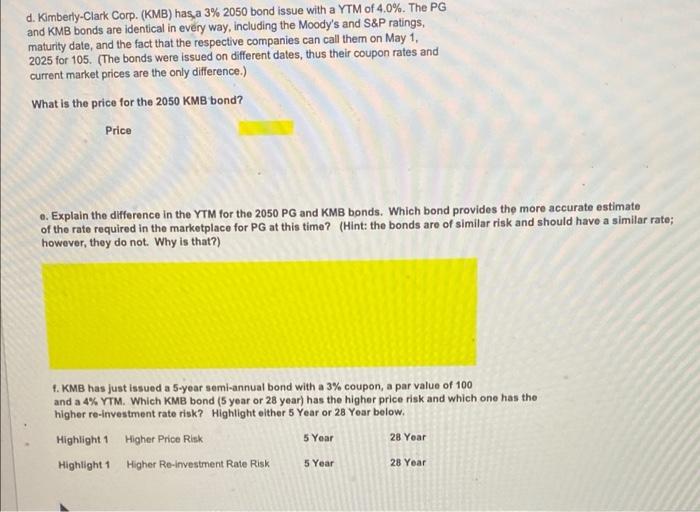

Problem 2175 points): Congratulations, you have been hired as an analyst at the Procter and Gamble Co. (PG). It is May 1, 2022 PG just made a coupon payment (semi-annual) on its *6% 2050" bonds that mature on May 1, 2050. The bonds currently sell for 110 with a par value of 100 a. What is the yield to maturity on the PG 2050 bond? YTM b. What is the Current Yield? The Capital Gains Yield? Current Yield Capital Gains Yield c. The PG 2050 bond was issued with a call provision that cannot be used the first five years. If the bond is called on its first allowable date of May 1, 2025, the company will pay bondholders 105 What is the yield to call on the PG 2050 bond? YTC- d. Kimberly-Clark Corp. (KMB) has a 3% 2050 bond issue with a YTM of 4.0%. The PG and KMB bonds are identical in every way, including the Moody's and S&P ratings maturity date, and the fact that the respective companies can call them on May 1, 2025 for 105. (The bonds were issued on different dates, thus their coupon rates and current market prices are the only difference.) What is the price for the 2050 KMB bond? Price . Explain the difference in the YTM for the 2050 PG and KMB bonds. Which bond provides the more accurate estimate of the rate required in the marketplace for PG at this time? (Hint: the bonds are of similar risk and should have a similar rate; however, they do not Why is that?) d. Kimberly-Clark Corp. (KMB) has a 3% 2050 bond issue with a YTM of 4.0%. The PG and KMB bonds are identical in every way, including the Moody's and S&P ratings, maturity date, and the fact that the respective companies can call them on May 1, 2025 for 105. (The bonds were issued on different dates, thus their coupon rates and current market prices are the only difference.) What is the price for the 2050 KMB bond? Price e. Explain the difference in the YTM for the 2050 PG and KMB bonds. Which bond provides the more accurate estimate of the rate required in the marketplace for PG at this time? (Hint: the bonds are of similar risk and should have a similar rate; however, they do not. Why is that?) 1. KMB has just issued a 5-year semi-annual bond with a 3% coupon, a par value of 100 and a 4% YTM. Which KMB bond (5 year or 28 year) has the higher price risk and which one has the higher re-investment rate risk? Highlight other 5 Year or 28 Year below. Highlight 1 Higher Price Risk 28 Year Highlight 1 Higher Re-investment Rate Risk 5 Year 28 Year 5 Year Problem 2175 points): Congratulations, you have been hired as an analyst at the Procter and Gamble Co. (PG). It is May 1, 2022 PG just made a coupon payment (semi-annual) on its *6% 2050" bonds that mature on May 1, 2050. The bonds currently sell for 110 with a par value of 100 a. What is the yield to maturity on the PG 2050 bond? YTM b. What is the Current Yield? The Capital Gains Yield? Current Yield Capital Gains Yield c. The PG 2050 bond was issued with a call provision that cannot be used the first five years. If the bond is called on its first allowable date of May 1, 2025, the company will pay bondholders 105 What is the yield to call on the PG 2050 bond? YTC- d. Kimberly-Clark Corp. (KMB) has a 3% 2050 bond issue with a YTM of 4.0%. The PG and KMB bonds are identical in every way, including the Moody's and S&P ratings maturity date, and the fact that the respective companies can call them on May 1, 2025 for 105. (The bonds were issued on different dates, thus their coupon rates and current market prices are the only difference.) What is the price for the 2050 KMB bond? Price . Explain the difference in the YTM for the 2050 PG and KMB bonds. Which bond provides the more accurate estimate of the rate required in the marketplace for PG at this time? (Hint: the bonds are of similar risk and should have a similar rate; however, they do not Why is that?) d. Kimberly-Clark Corp. (KMB) has a 3% 2050 bond issue with a YTM of 4.0%. The PG and KMB bonds are identical in every way, including the Moody's and S&P ratings, maturity date, and the fact that the respective companies can call them on May 1, 2025 for 105. (The bonds were issued on different dates, thus their coupon rates and current market prices are the only difference.) What is the price for the 2050 KMB bond? Price e. Explain the difference in the YTM for the 2050 PG and KMB bonds. Which bond provides the more accurate estimate of the rate required in the marketplace for PG at this time? (Hint: the bonds are of similar risk and should have a similar rate; however, they do not. Why is that?) 1. KMB has just issued a 5-year semi-annual bond with a 3% coupon, a par value of 100 and a 4% YTM. Which KMB bond (5 year or 28 year) has the higher price risk and which one has the higher re-investment rate risk? Highlight other 5 Year or 28 Year below. Highlight 1 Higher Price Risk 28 Year Highlight 1 Higher Re-investment Rate Risk 5 Year 28 Year 5 Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts