Question: Please show how to solve in excel! Will give thumbs up, thanks! 1 Determine the marginal profitability from relaxing the credit policy from the present

Please show how to solve in excel! Will give thumbs up, thanks!

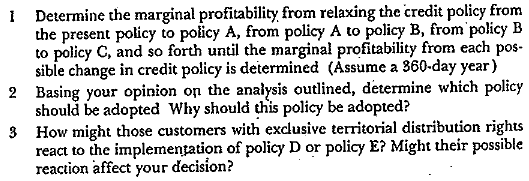

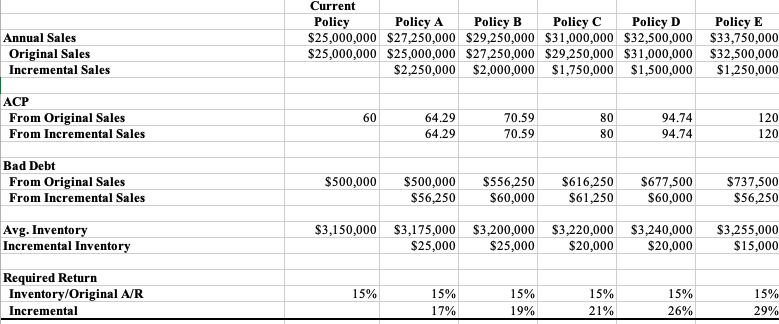

1 Determine the marginal profitability from relaxing the credit policy from the present policy to policy A, from policy A to policy B, from policy B to policy C, and so forth until the marginal profitability from each pos- sible change in credit policy is determined (Assume a 360-day year) 2 Basing your opinion on the analysis outlined, determine which policy should be adopted Why should this policy be adopted? 3 How might those customers with exclusive territorial distribution rights react to the implementation of policy D or policy E? Might their possible reaction affect your decision? Annual Sales Original Sales Incremental Sales Current Policy Policy A Policy B Policy C Policy D Policy E $25,000,000 $27,250,000 $29,250,000 $31,000,000 $32,500,000 $33,750,000 $25,000,000 $25,000,000 $27,250,000 $29,250,000 $31,000,000 $32,500,000 $2,250,000 $2,000,000 $1,750,000 $1,500,000 $1,250,000 ACP From Original Sales From Incremental Sales 60 64.29 64.29 70.59 70.59 80 80 94.74 94.74 120 120 Bad Debt From Original Sales From Incremental Sales $500,000 $500,000 $56,250 $556,250 $60,000 $616,250 $61,250 $677,500 $60,000 $737,500 $56,250 Avg. Inventory Incremental Inventory $3,150,000 $3,175,000 $3,200,000 $25,000 $25,000 $3,220,000 $3,240,000 $20,000 $20,000 $3,255,000 $15,000 Required Return Inventory/Original A/R Incremental 15% 15% 17% 15% 19% 15% 21% 15% 26% 15% 29% 1 Determine the marginal profitability from relaxing the credit policy from the present policy to policy A, from policy A to policy B, from policy B to policy C, and so forth until the marginal profitability from each pos- sible change in credit policy is determined (Assume a 360-day year) 2 Basing your opinion on the analysis outlined, determine which policy should be adopted Why should this policy be adopted? 3 How might those customers with exclusive territorial distribution rights react to the implementation of policy D or policy E? Might their possible reaction affect your decision? Annual Sales Original Sales Incremental Sales Current Policy Policy A Policy B Policy C Policy D Policy E $25,000,000 $27,250,000 $29,250,000 $31,000,000 $32,500,000 $33,750,000 $25,000,000 $25,000,000 $27,250,000 $29,250,000 $31,000,000 $32,500,000 $2,250,000 $2,000,000 $1,750,000 $1,500,000 $1,250,000 ACP From Original Sales From Incremental Sales 60 64.29 64.29 70.59 70.59 80 80 94.74 94.74 120 120 Bad Debt From Original Sales From Incremental Sales $500,000 $500,000 $56,250 $556,250 $60,000 $616,250 $61,250 $677,500 $60,000 $737,500 $56,250 Avg. Inventory Incremental Inventory $3,150,000 $3,175,000 $3,200,000 $25,000 $25,000 $3,220,000 $3,240,000 $20,000 $20,000 $3,255,000 $15,000 Required Return Inventory/Original A/R Incremental 15% 15% 17% 15% 19% 15% 21% 15% 26% 15% 29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts