Question: please show math Problem 9.4 (LOU) Excel Present Value and What if Analysis National Cruise Line is considering the acquisition of a new ship that

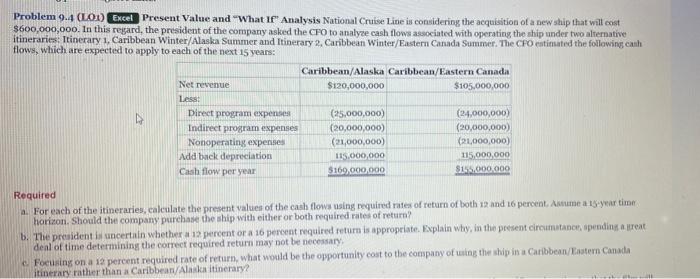

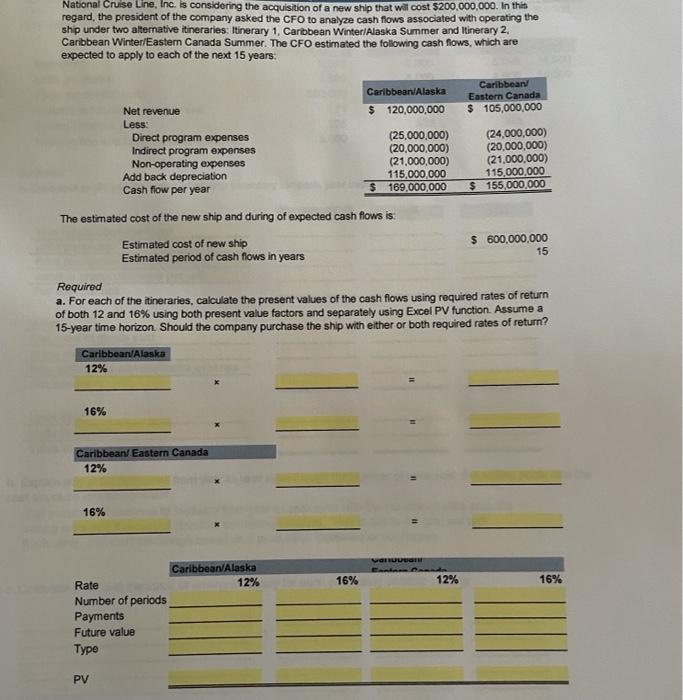

Problem 9.4 (LOU) Excel Present Value and "What if Analysis National Cruise Line is considering the acquisition of a new ship that will cost $600,000,000. In this regard, the president of the company asked the CFO to analyse cash flows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean Winter/Alaska Summer and Itinerary 3, Caribbean Winter/Eastern Canada Summer, The CFO estimated the following canh flows, which are expected to apply to each of the next 15 years: Caribbean/Alaska Caribbean/Eastern Canada Net revenue $120,000,000 $105,000,000 Less: Direct program expenses (25,000,000) (24,000,000) Indirect program expenses (20,000,000) (20,000,000) Nonoperating expenses (21,000,000) (21,000,000) Ada back depreciation 115.000.000 115,000,000 Cash flow per year $160,000,000 $155.000.000 Required a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 12 and 16 percent. Asume a 15-year time horizon. Should the company purchase the ship with either or both required rates of return? b. The president is certain whether a 12 percent or a 16 percent required return is appropriate. Explain why, in the poesent circumstance, apending a great deal of time determining the correct required return may not be necessary e. Focusing on a 12 percent required rate of return, what would be the opportunity cost to the company of using the ship in a Caribbean/Eastern Canada itinerary rather than a Caribbean/Alaskaitinerary? National Cruise Line, Inc. is considering the acquisition of a new ship that will cost $200,000,000. In this regard, the president of the company asked the CFO to analyze cash flows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean Winter/Alaska Summer and Itinerary 2. Caribbean Winter/Eastern Canada Summer. The CFO estimated the following cash flows, which are expected to apply to each of the next 15 years. Caribbean Caribbean/Alaska Eastern Canada Net revenue $ 120,000,000 $ 105,000,000 Less: Direct program expenses (25,000,000) (24,000,000) Indirect program expenses (20,000,000) (20,000,000) Non-operating expenses (21,000,000) (21,000,000) Add back depreciation 115,000,000 115,000,000 Cash flow per year $ 169,000,000 $ 155,000,000 The estimated cost of the new ship and during of expected cash flows is Estimated cost of new ship $ 600,000,000 Estimated period of cash flows in years 15 Required a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 12 and 16% using both present value factors and separately using Excel PV function. Assume a 15-year time horizon Should the company purchase the ship with either or both required rates of return? Caribbean/Alaska 12% 16% Caribbean/ Eastern Canada 12% 16% VUUGIH 16% 12% 16% Caribbean/Alaska Rate 12% Number of periods Payments Future value Type PV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts