Question: This is the question I need help with: Problem 9-4 Present Value and What If Analysis National Cruise Line, Inc. is considering the acquisition of

This is the question I need help with:

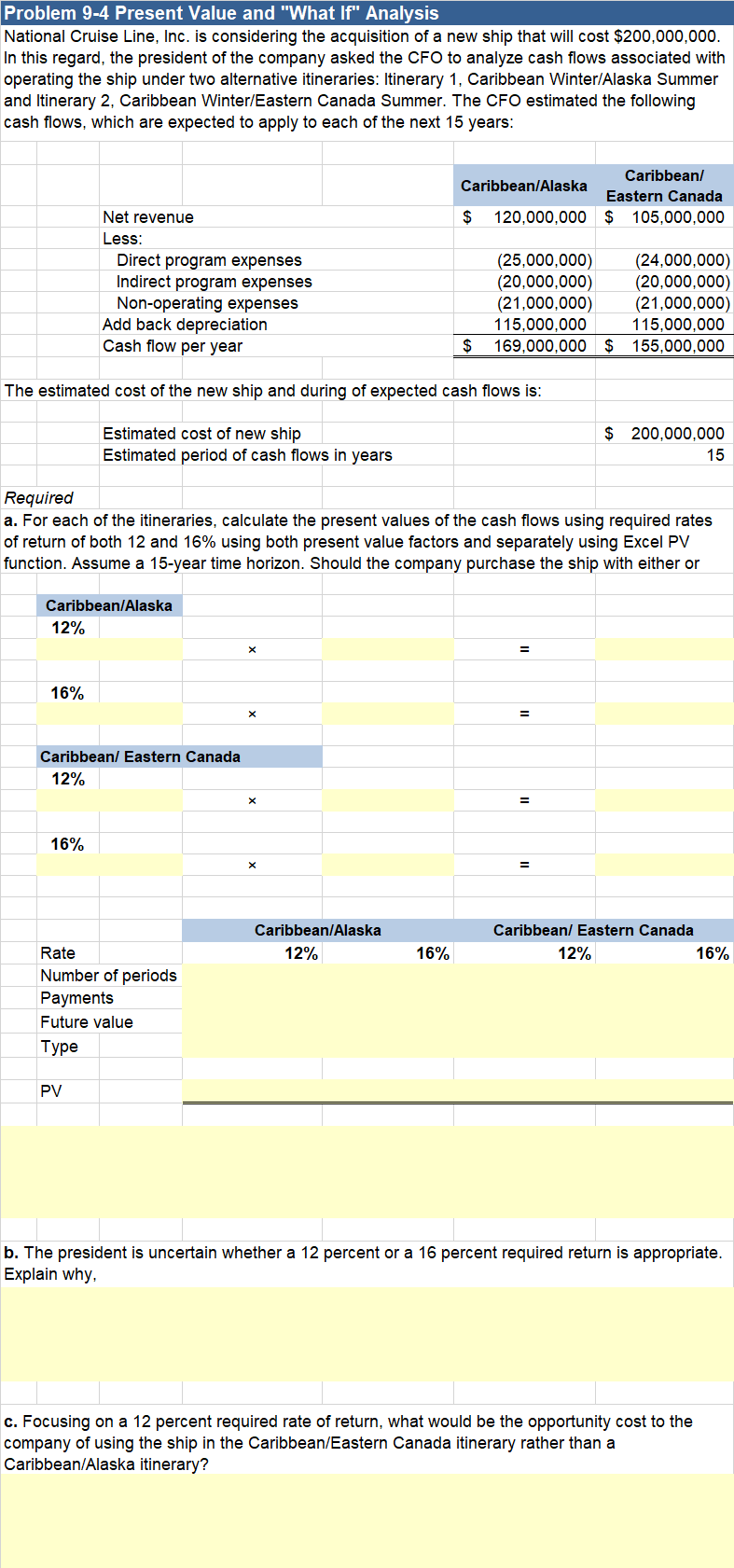

Problem 9-4 Present Value and "What If" Analysis National Cruise Line, Inc. is considering the acquisition of a new ship that will cost $200,000,000. In this regard, the president of the company asked the CFO to analyze cash ows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean WinterIAIaska Summer and Itinerary 2, Caribbean Winterr'Eastern Canada Summer. The CFO estimated the following cash flows, which are expected to apply to each of the next 15 years: - Caribbean! Canbbeanrnlaska Eastern Camda Net revenue $ 120,000,000 $ 105,000,000 Less: Direct program expenses (25,000,000) (24,000,000) Indirect program expenses (20,000,000) (20,000,000) Non-operating expenses (21,000,000) (21,000,000) Add back depreciation 115,000,000 115,000,000 Cash ow per year $ 169,000,000 $ 155,000,000 The estimated cost ofthe new ship and during of expected cash flows is: Estimated cost of new ship $ 200,000,000 Estimated period of cash flows in years 15 Required a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 12 and 16% using both present value factors and separately using Excel PV function. Assume a 15-year time horizon. Should the company purchase the ship with either or Caribbeanl'Alaska 12% 16% CaribbearrrI Eastern Canada 12% 16% CaribbeanrAIaska Caribbean! Eastern Canada Rate 12% 16% 12% 16% Number of periods Payments Future value Type PV b. The president is uncertain whether a 12 percent or a 16 percent required return is appropriate. Explain why, 1:. Focusing on a 12 percent required rate of return, what would be the opportunity cost to the company of using the ship in the Caribbeanr'Eastern Canada itinerary rather than a CaribbeanrAIasKa itinerary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts