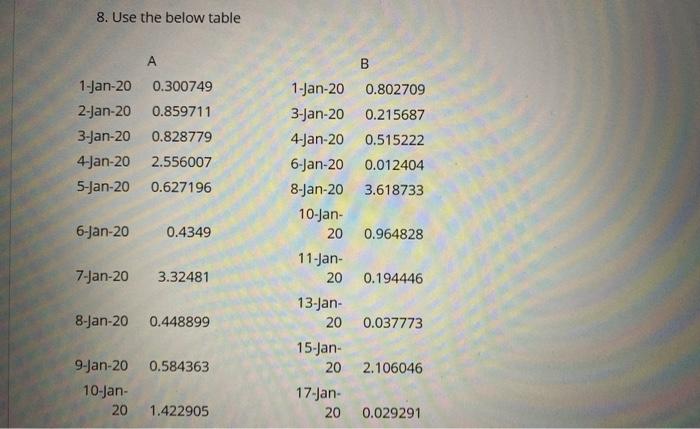

Question: please show step by step 8. Use the below table A B 1-Jan-20 0.300749 2-Jan-20 0.859711 3-Jan-20 0.828779 4-Jan-20 2.556007 5-Jan-20 0.627196 6-Jan-20 0.4349 1-Jan-20

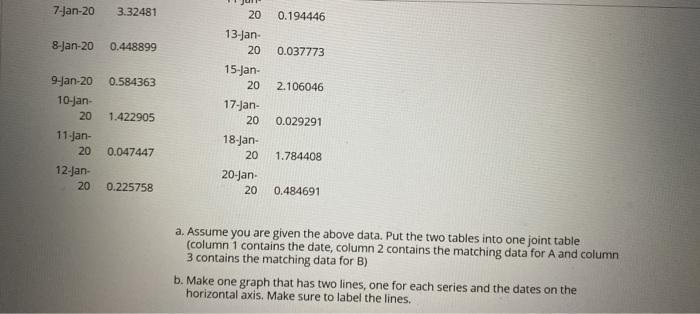

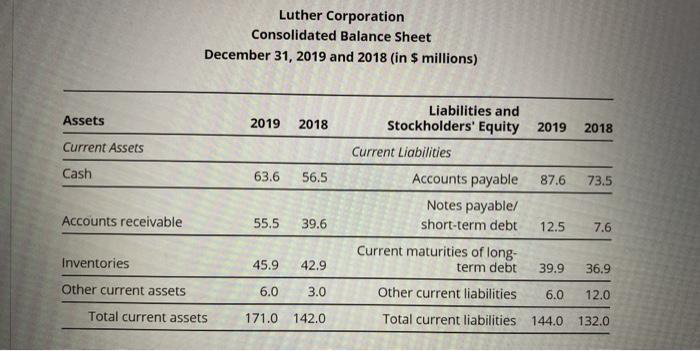

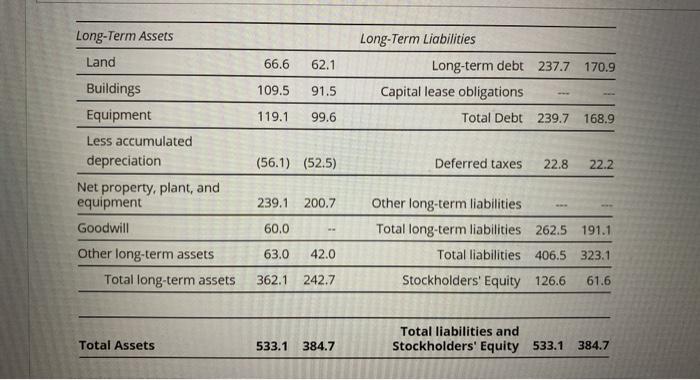

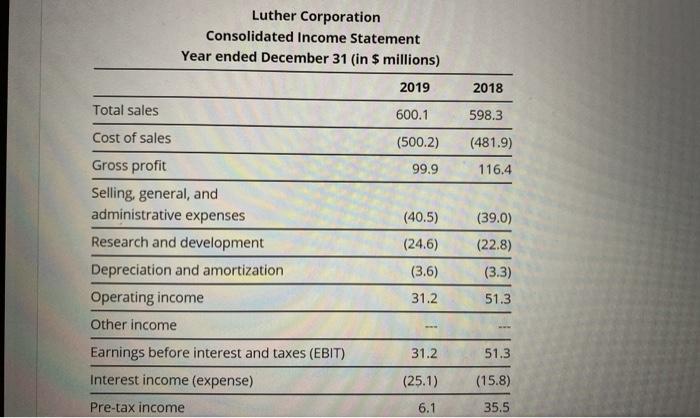

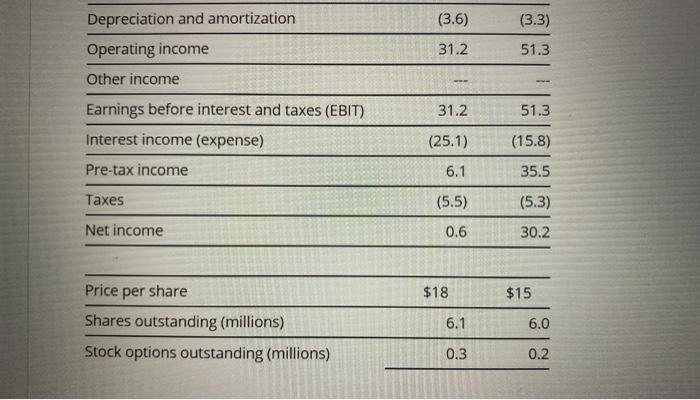

8. Use the below table A B 1-Jan-20 0.300749 2-Jan-20 0.859711 3-Jan-20 0.828779 4-Jan-20 2.556007 5-Jan-20 0.627196 6-Jan-20 0.4349 1-Jan-20 0.802709 3-Jan-20 0.215687 4-Jan-20 0.515222 6-Jan-20 0.012404 8-Jan-20 3.618733 10-Jan- 20 0.964828 11-Jan- 20 0.194446 13-Jan- 20 0.037773 15-Jan- 20 2.106046 17-Jan- 20 0.029291 7-Jan-20 3.32481 8-Jan-20 0.448899 0.584363 9-Jan-20 10-Jan- 20 1.422905 7-Jan-20 3.32481 20 0.194446 8-Jan-20 0.448899 0.037773 13-Jan- 20 15-Jan- 20 17-Jan- 0.584363 2.106046 1.422905 20 0.029291 9-Jan-20 10-Jan- 20 11.jan- 20 12-Jan- 20 0.047447 1.784408 18-jan- 20 20-Jan- 20 0.225758 0.484691 a. Assume you are given the above data. Put the two tables into one joint table (column 1 contains the date, column 2 contains the matching data for A and column 3 contains the matching data for B) b. Make one graph that has two lines, one for each series and the dates on the horizontal axis. Make sure to label the lines. Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in $ millions) Assets 2019 2018 2018 Current Assets Cash 63.6 56.5 73.5 Liabilities and Stockholders' Equity 2019 Current Liabilities Accounts payable 87.6 Notes payable/ short-term debt 12.5 Current maturities of long- term debt 39.9 Accounts receivable 55.5 39.6 7.6 Inventories 45.9 42.9 36.9 Other current assets 6.0 3.0 Other current liabilities 6.0 12.0 Total current assets 171.0 142.0 Total current liabilities 144.0 132.0 Long-Term Assets Land 66.6 62.1 Long-Term Liabilities Long-term debt 237.7 170.9 Capital lease obligations Total Debt 239.7 168.9 109.5 91.5 119.1 99.6 (56.1) (52.5) Deferred taxes 22.8 22.2 Buildings Equipment Less accumulated depreciation Net property, plant, and equipment Goodwill Other long-term assets Total long-term assets 239.1 200.7 60.0 Other long-term liabilities Total long-term liabilities 262.5 191.1 Total liabilities 406.5 323.1 Stockholders' Equity 126.6 61.6 63.0 42.0 362.1 242.7 Total Assets Total liabilities and Stockholders' Equity 533.1 533.1 384.7 384.7 Luther Corporation Consolidated Income Statement Year ended December 31 (in $ millions) 2019 2018 Total sales 600.1 598.3 Cost of sales (500.2) (481.9) 99.9 116.4 (40.5) (24.6) (39.0) (22.8) (3.6) (3.3) Gross profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pre-tax income 31.2 51.3 31.2 51.3 (25.1) (15.8) 6.1 35.5 (3.6) (3.3) Depreciation and amortization Operating income Other income 31.2 51.3 31.2 51.3 Earnings before interest and taxes (EBIT) Interest income (expense) (25.1) (15.8) Pre-tax income 6.1 35.5 Taxes (5.5) (5.3) Net income 0.6 30.2 $18 $15 Price per share Shares outstanding (millions) Stock options outstanding (millions) 6.1 6.0 0.3 0.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts