Question: Please show step by step in derivagem how to do this problem, I don't want just the final answer. Also, what is meant by 1

Please show step by step in derivagem how to do this problem, I don't want just the final answer. Also, what is meant by 1 x 4, 2 x 3, in the first sentence?

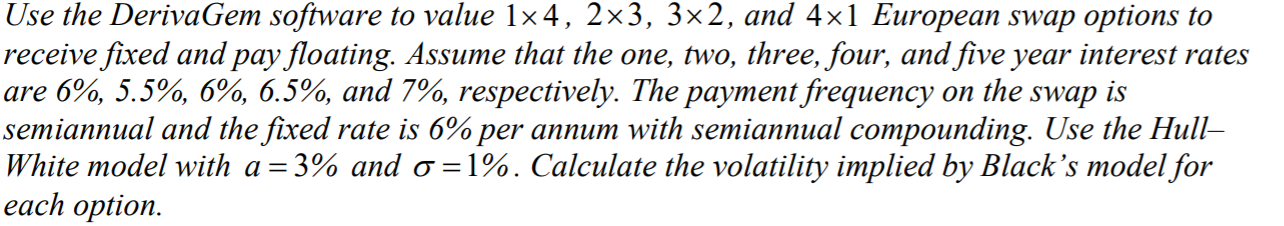

Use the DerivaGem software to value 1x4, 2x3, 3x2, and 4x1 European swap options to receive fixed and pay floating. Assume that the one, two, three, four, and five year interest rates are 6%, 5.5%, 6%, 6.5%, and 7%, respectively. The payment frequency on the swap is semiannual and the fixed rate is 6% per annum with semiannual compounding. Use the Hull- White model with a = 3% and o=1%. Calculate the volatility implied by Blacks model for each option. Use the DerivaGem software to value 1x4, 2x3, 3x2, and 4x1 European swap options to receive fixed and pay floating. Assume that the one, two, three, four, and five year interest rates are 6%, 5.5%, 6%, 6.5%, and 7%, respectively. The payment frequency on the swap is semiannual and the fixed rate is 6% per annum with semiannual compounding. Use the Hull- White model with a = 3% and o=1%. Calculate the volatility implied by Blacks model for each option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts