Question: PLEASE SHOW STEPS, I NEED IT FOR STUDYING The balance sheet shown for P and S Company is to be used for Case I and

PLEASE SHOW STEPS, I NEED IT FOR STUDYING

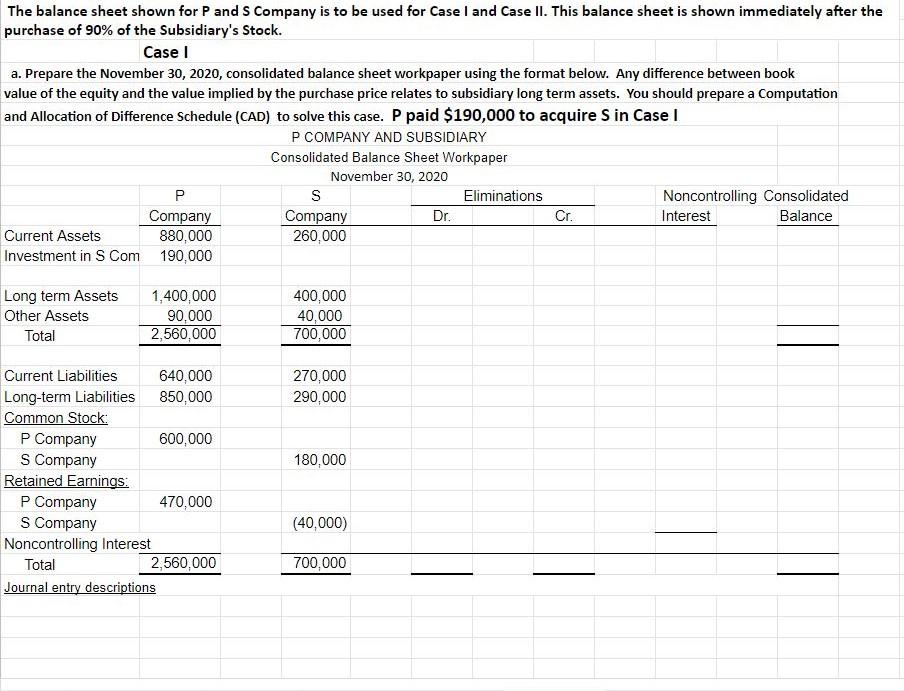

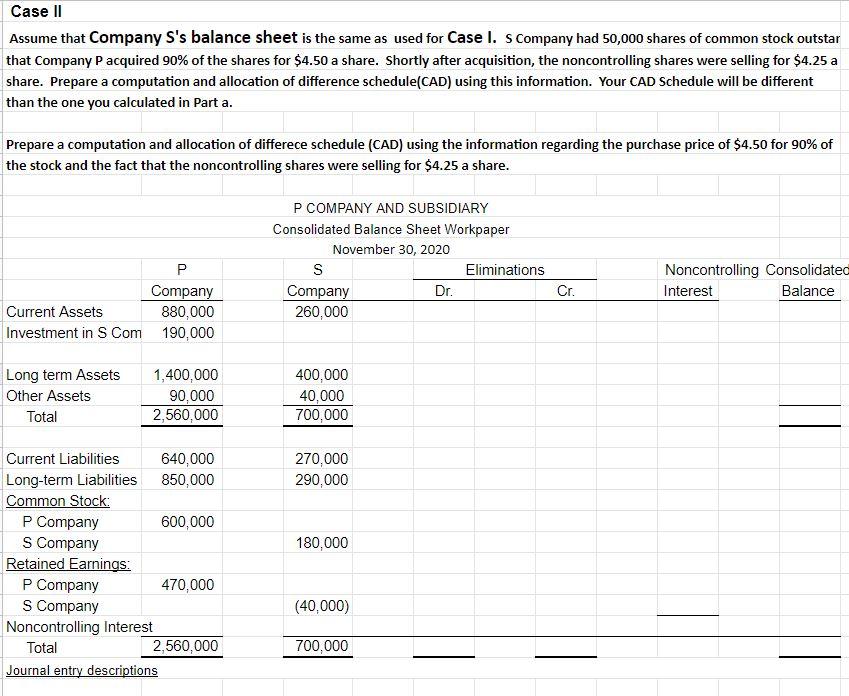

The balance sheet shown for P and S Company is to be used for Case I and Case II. This balance sheet is shown immediately after the purchase of 90% of the Subsidiary's Stock. Case a. Prepare the November 30, 2020, consolidated balance sheet workpaper using the format below. Any difference between book value of the equity and the value implied by the purchase price relates to subsidiary long term assets. You should prepare a Computation and Allocation of Difference Schedule (CAD) to solve this case. P paid $190,000 to acquire S in Case I P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2020 S Eliminations Noncontrolling Consolidated Company Company Dr. Cr. Interest Balance Current Assets 880,000 260,000 Investment in S Com 190,000 Long term Assets Other Assets Total 1,400,000 90,000 2,560,000 400,000 40,000 700,000 270,000 290,000 180,000 Current Liabilities 640,000 Long-term Liabilities 850,000 Common Stock: P Company 600,000 S Company Retained Earnings: P Company 470,000 S Company Noncontrolling Interest Total 2,560,000 Journal entry descriptions (40,000) 700,000 Case II Assume that Company S's balance sheet is the same as used for Case I. s Company had 50,000 shares of common stock outstar that Company Pacquired 90% of the shares for $4.50 a share. Shortly after acquisition, the noncontrolling shares were selling for $4.25 a share. Prepare a computation and allocation of difference schedule(CAD) using this information. Your CAD Schedule will be different than the one you calculated in Part a. Prepare a computation and allocation of differece schedule (CAD) using the information regarding the purchase price of $4.50 for 90% of the stock and the fact that the noncontrolling shares were selling for $4.25 a share. P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2020 S Eliminations Company Dr. 260,000 Noncontrolling Consolidated Interest Balance Cr. P Company Current Assets 880,000 Investment in S Com 190,000 Long term Assets Other Assets Total 1,400,000 90,000 2,560,000 400,000 40,000 700,000 270,000 290,000 180,000 Current Liabilities 640,000 Long-term Liabilities 850,000 Common Stock: P Company 600,000 S Company Retained Earnings: P Company 470,000 S Company Noncontrolling Interest Total 2,560,000 Journal entry descriptions (40,000) 700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts