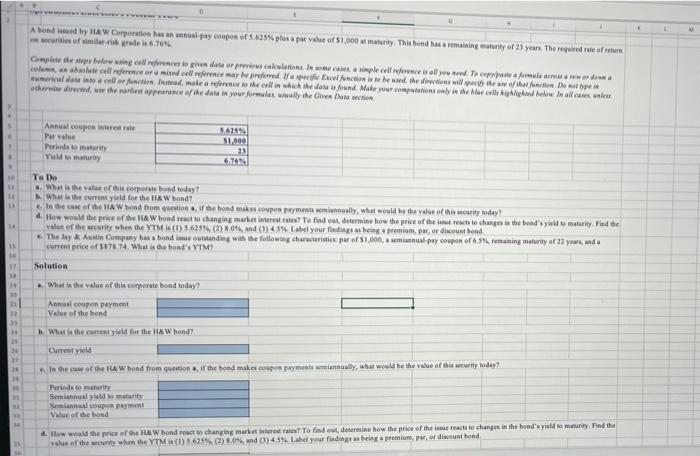

Question: please show steps in how you get the answer Abonded by HAW Corporation hay coups of 5.625% spava of 51.000 unity. Thished remaining maturity of

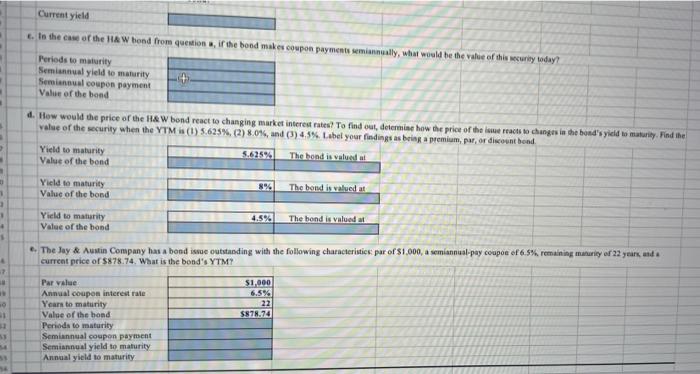

Abonded by HAW Corporation hay coups of 5.625% spava of 51.000 unity. Thished remaining maturity of 23 years. The required rate of return series of simir-risk side is 6.76% Complete the opening cell refers to general ple cell reference is all you need to be a formule crew coloms, an absolutell reference of a model reference may be referred. We speciel function in de wand the directions will the weather fact that open umane dele into a cell or period, make a reference to the call in which the date found. Make your computation only be the Merle dele. In all cate unten he did, where appearance of the data is your first wally the Glen Dil Asal coupon intrale Par value Perioda Ymary 51.000 23 6.769 11 11 15 1 To Do . What is the value os corporate bond today? What is the current yield for the HAW hond? c. In the case of the HAW hond from question, if the bond makes coupon payments semiannually, what would be the value of this security today! 4. How would the price of the HAW hond react to changing market interest rate? To find out determine how the price of the rest to change in the band's yet to maturity. Find de value of the curity when the YTM (1) 5625%) 04 and()48% Label your findings being premium, par or discounted The lay Austin Company has a bonde landing with the following characteristics par of 1,000, manual pay coupon of 6 ming maturity of 27 year, and a current price of 5878.74. What is the band's YTM Solution What is the value of this corporate bond today? Annual coupon payment Value of the bond 11 20 13 14 What is the current yield for the HW hood? Current yield 21 s. In the core of the HW hond from westion, if the band makes couponyments wmiannually, what would be the value of this security today! 41 Periods to try Seminal yield 10 mosturity Seminal coupon payment Value of the band 4. Now well the price of the HRW hond react to changing market interest rates? To find out determine how the price of the we reacts to changes in the band's yield to manunty, Find the value of the security when the YTM (0) 5.625% (2) 8.01 and O) 43% Label your finding premium, por discount bond Current yield c. to the case of the RAW bood from questions, in the bed makes coupon payments manually, what would be the value of this security today? Periods to maturity Semiannual yield to maturity Semineul coupon payment Value of the bond + d. How would the price of the HAW bond react to changing market interest rates! To find out, determine how the price of the reacts to changes in the bond's yidd to maturity. Find the value of the security when the YTM is (1) 5.625%, (2) 8.0%, and (3) 4.5% Label your findings as bring a premium, pw, or discount bond Yield to maturity 5.625% The hond is valued at Value of the bond Yield te maturity Value of the bond 8% The bond is valued 1 Yield to maturity Value of the bond 4.5% The bond is valued at . 1 . The Jay & Austin Company has a bond issue outstanding with the following characteristics par of $1.000, a semiannual pay coupoe of 6.5% remaining maurity of 22 years and a current price of $878.74. What is the bond's YTM Par value $1,000 Annual coupon interest rate 6.5% Years to maturity 22 Value of the hond $878.74 Periods to maturity Semiannual coupon payment Semiannual yield to maturity Annual yield to maturity 1 Abonded by HAW Corporation hay coups of 5.625% spava of 51.000 unity. Thished remaining maturity of 23 years. The required rate of return series of simir-risk side is 6.76% Complete the opening cell refers to general ple cell reference is all you need to be a formule crew coloms, an absolutell reference of a model reference may be referred. We speciel function in de wand the directions will the weather fact that open umane dele into a cell or period, make a reference to the call in which the date found. Make your computation only be the Merle dele. In all cate unten he did, where appearance of the data is your first wally the Glen Dil Asal coupon intrale Par value Perioda Ymary 51.000 23 6.769 11 11 15 1 To Do . What is the value os corporate bond today? What is the current yield for the HAW hond? c. In the case of the HAW hond from question, if the bond makes coupon payments semiannually, what would be the value of this security today! 4. How would the price of the HAW hond react to changing market interest rate? To find out determine how the price of the rest to change in the band's yet to maturity. Find de value of the curity when the YTM (1) 5625%) 04 and()48% Label your findings being premium, par or discounted The lay Austin Company has a bonde landing with the following characteristics par of 1,000, manual pay coupon of 6 ming maturity of 27 year, and a current price of 5878.74. What is the band's YTM Solution What is the value of this corporate bond today? Annual coupon payment Value of the bond 11 20 13 14 What is the current yield for the HW hood? Current yield 21 s. In the core of the HW hond from westion, if the band makes couponyments wmiannually, what would be the value of this security today! 41 Periods to try Seminal yield 10 mosturity Seminal coupon payment Value of the band 4. Now well the price of the HRW hond react to changing market interest rates? To find out determine how the price of the we reacts to changes in the band's yield to manunty, Find the value of the security when the YTM (0) 5.625% (2) 8.01 and O) 43% Label your finding premium, por discount bond Current yield c. to the case of the RAW bood from questions, in the bed makes coupon payments manually, what would be the value of this security today? Periods to maturity Semiannual yield to maturity Semineul coupon payment Value of the bond + d. How would the price of the HAW bond react to changing market interest rates! To find out, determine how the price of the reacts to changes in the bond's yidd to maturity. Find the value of the security when the YTM is (1) 5.625%, (2) 8.0%, and (3) 4.5% Label your findings as bring a premium, pw, or discount bond Yield to maturity 5.625% The hond is valued at Value of the bond Yield te maturity Value of the bond 8% The bond is valued 1 Yield to maturity Value of the bond 4.5% The bond is valued at . 1 . The Jay & Austin Company has a bond issue outstanding with the following characteristics par of $1.000, a semiannual pay coupoe of 6.5% remaining maurity of 22 years and a current price of $878.74. What is the bond's YTM Par value $1,000 Annual coupon interest rate 6.5% Years to maturity 22 Value of the hond $878.74 Periods to maturity Semiannual coupon payment Semiannual yield to maturity Annual yield to maturity 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts