Question: please show steps without using excel. thank you. You are given the following information concerning Around Town Tours: Common stock: 265,000 shares of common stock

please show steps without using excel. thank you.

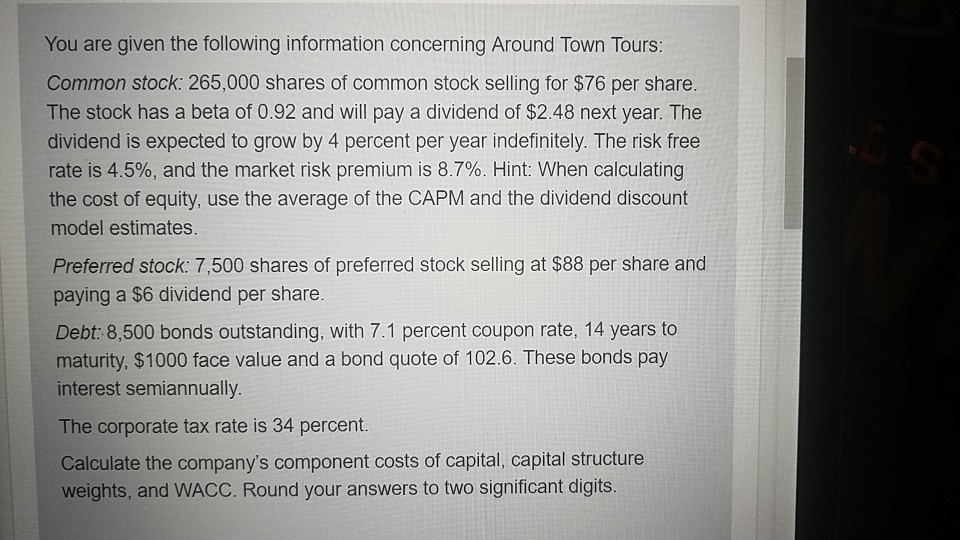

You are given the following information concerning Around Town Tours: Common stock: 265,000 shares of common stock selling for $76 per share. The stock has a beta of 0.92 and will pay a dividend of $2.48 next year. The dividend is expected to grow by 4 percent per year indefinitely. The risk free rate is 4.5%, and the market risk premium is 8.7%. Hint: When calculating the cost of equity, use the average of the CAPM and the dividend discount model estimates. Preferred stock: 7,500 shares of preferred stock selling at $88 per share and paying a $6 dividend per share. Debt: 8,500 bonds outstanding, with 7.1 percent coupon rate, 14 years to maturity, $1000 face value and a bond quote of 102.6. These bonds pay interest semiannually. The corporate tax rate is 34 percent. Calculate the company's component costs of capital, capital structure weights, and WACC. Round your answers to two significant digits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts