Question: please show work 2. ( 10pts ) You think that the price of a stock is likely to increase from $50 to $60 over the

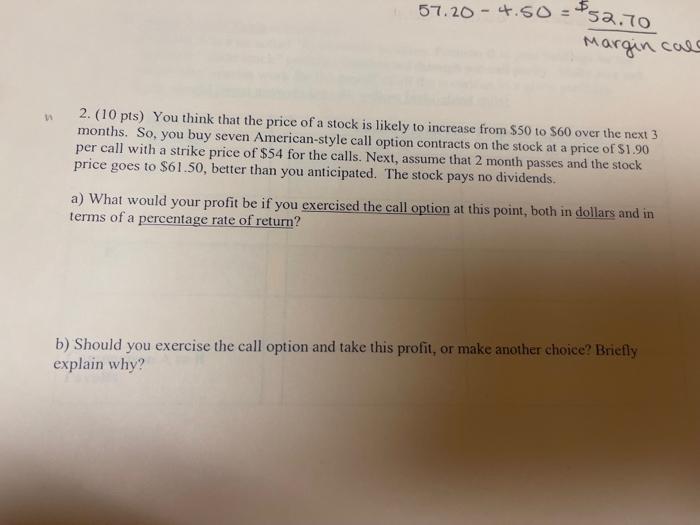

2. ( 10pts ) You think that the price of a stock is likely to increase from $50 to $60 over the next 3 months. So, you buy seven American-style call option contracts on the stock at a price of $1.90 per call with a strike price of $54 for the calls. Next, assume that 2 month passes and the stock price goes to $61.50, better than you anticipated. The stock pays no dividends. a) What would your profit be if you exercised the call option at this point, both in dollars and in terms of a percentage rate of return? b) Should you exercise the call option and take this profit, or make another choice? Briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts