Question: Please show work! A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be required. The project is replacing old

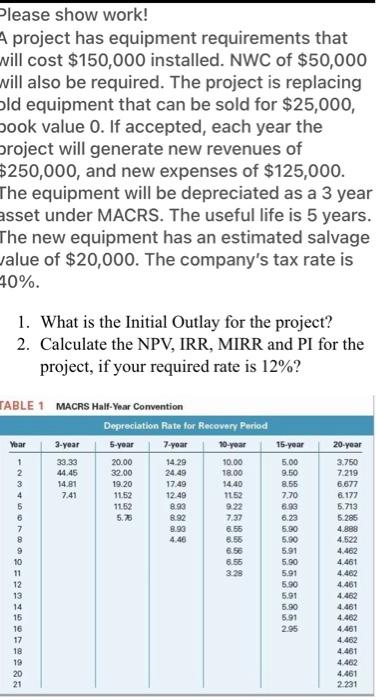

Please show work! A project has equipment requirements that will cost $150,000 installed. NWC of $50,000 will also be required. The project is replacing old equipment that can be sold for $25,000, pook value 0. If accepted, each year the project will generate new revenues of $250,000, and new expenses of $125,000. The equipment will be depreciated as a 3 year asset under MACRS. The useful life is 5 years. The new equipment has an estimated salvage value of $20,000. The company's tax rate is 70% 1. What is the Initial Outlay for the project? 2. Calculate the NPV, IRR, MIRR and PI for the project, if your required rate is 12%? TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 10-year 20.00 Year 3-year 5-year 15-year 20-year 33.33 44.45 14.81 7.41 32.00 19.20 1152 1152 5.75 7-year 14.29 24.49 17.49 12.49 8.93 8.92 8.90 4.46 10.00 18.00 14.40 1152 9.22 7.37 6.55 6.56 5.00 9.50 8.56 7.70 8.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 10 6.56 3.29 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.482 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 16 17 18 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts