Question: please show work ans explain why number 16 is A 13) When a lender refuses to make a loan, interest rate or even a higher

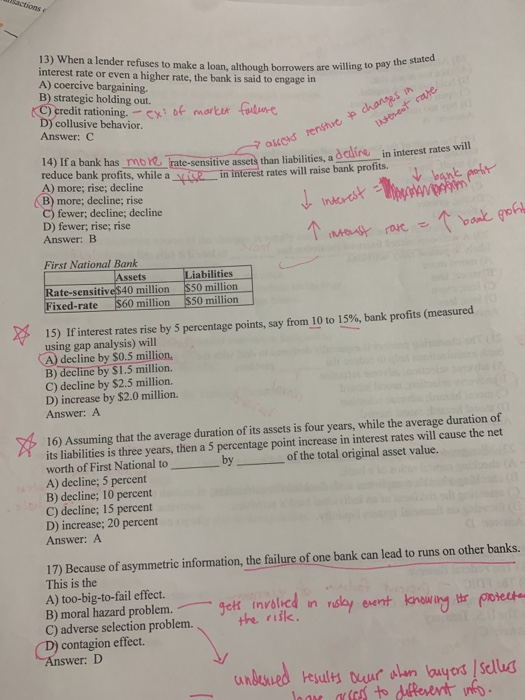

13) When a lender refuses to make a loan, interest rate or even a higher rate, the bank is said to engage in A) coercive bargaining. B) strategic holding out. C) credit rationing. -CY D) collusive behavior. Answer: C although borrowers are willing to pay the stated art reduce bank profwle rate-sensitive assets than liabilities, a dcdlire in interest rates will A) more; rise; decline ded 14) If a bank has mo reduce banlk e a Miz in interest rates will raise bank profits. B) more; decline; rise fewer; decline; decline D) fewer; rise; rise Answer: B nkerst hua First National Bank ssets iabilities Rate-sensitive 40 million $50 million Fixed-rate 0 million $50 million 15) If interest rates rise by 5 percentage points, say from 10 to 15%, bank profits (measured using gap analysis) will A) decline by $0.5 million, B) decline by $1.5 million. C) decline by $2.5 million. D) increase by $2.0 million. Answer: A 16) Assuming that the average duration of its assets is four years, while the average duration of its liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of First National to A) decline; 5 percent B) decline; 10 percent C) decline; 15 percent D) increase; 20 percent Answer: A by of the total original asset value. 17) Because of asymmetric information, the failure of one bank can lead to runs on other banks. This is the A) too-big-to-fail effect B) moral hazard problem.ge nvalcd n rsky eentwiy trporet (D) contagion effect C) adverse selection problem.he risk. Answer: D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts