Question: please show work for each answer and explain, thanks. A. Fixed Assets=$200; Total Assets $700. Current Liabilities $300; Long-term Debt=$100; Equity=$300. Current Assets-$200; Total Assets=$400.

please show work for each answer and explain, thanks.

please show work for each answer and explain, thanks.

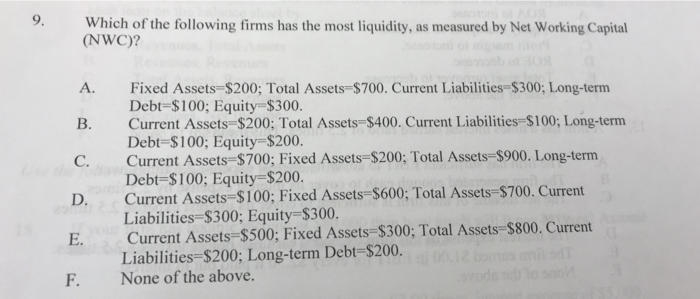

A. Fixed Assets=$200; Total Assets $700. Current Liabilities $300; Long-term Debt=$100; Equity=$300. Current Assets-$200; Total Assets=$400. Current Liabilities=$100; Long-term Debt-$100; Equity=$200. Current Assets=$700; Fixed Assets=$200; Total Assets=$900. Long-term Debt=$100; Equity=$200. Current Assets=$100; Fixed Assets=$600; Total Assets=$700. Current Liabilities $300; Equity=$300. Current Assets=$500; Fixed Assets=$300: Total Assets=$800. Current Liabilities=$200; Long-term Debt-$200. None of the above. 9. Which of the following firms has the most liquidity, as measured by Net Working Capital (NWC)? A. Fixed Assets $200; Total Assets=$700. Current Liabilities $300; Long-term Debt-$100; Equity=$300. Current Assets=$200; Total Assets $400. Current Liabilities=$100; Long-term Debt-$100; Equity=$200. Current Assets=$700; Fixed Assets=$200: Total Assets=$900. Long-term Debt=$100; Equity=$200. Current Assets=$100; Fixed Assets=S600; Total Assets-$700. Current Liabilities=$300; Equity=$300. Current Assets=$500; Fixed Assets=$300: Total Assets $800. Current Liabilities=$200; Long-term Debt-$200. None of the above. F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts