Question: Please show work in Excel. Alpha and Beta bonds. Par is 100. 2. Suppose you are a private wealth manager. You have a client that

Please show work in Excel. Alpha and Beta bonds. Par is 100.

Please show work in Excel. Alpha and Beta bonds. Par is 100.

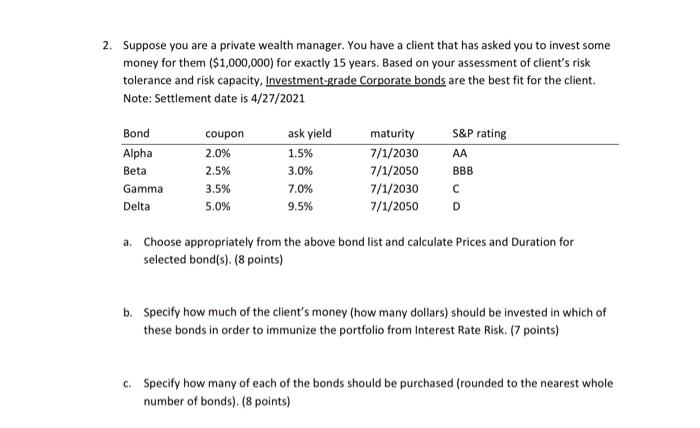

2. Suppose you are a private wealth manager. You have a client that has asked you to invest some money for them ($1,000,000) for exactly 15 years. Based on your assessment of client's risk tolerance and risk capacity, Investment-grade Corporate bonds are the best fit for the client. Note: Settlement date is 4/27/2021 Bond Alpha Beta Gamma Delta coupon 2.0% 2.5% 3.5% 5.0% ask yield 1.5% 3.0% 7.0% 9.5% maturity 7/1/2030 7/1/2050 7/1/2030 7/1/2050 S&P rating AA BBB D a. Choose appropriately from the above bond list and calculate Prices and Duration for selected bond(s). (8 points) b. Specify how much of the client's money (how many dollars) should be invested in which of these bonds in order to immunize the portfolio from Interest Rate Risk. (7 points) c. Specify how many of each of the bonds should be purchased (rounded to the nearest whole number of bonds). (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts