Question: Please show work in excel with formulas Problem 4 The current 1-year spot rate is 3%, and ifi is 3.5%. Investors require a liquidity premium

Please show work in excel with formulas

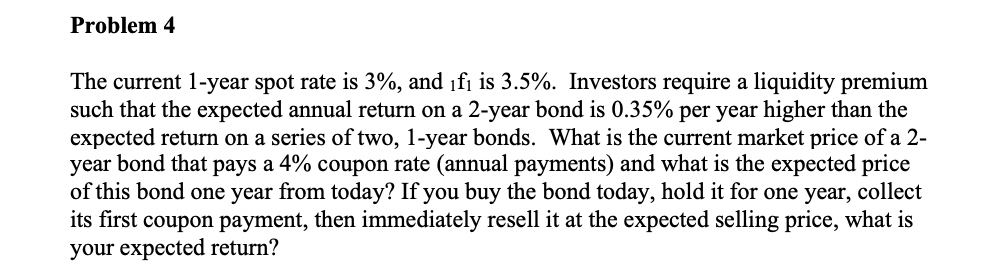

Problem 4 The current 1-year spot rate is 3%, and ifi is 3.5%. Investors require a liquidity premium such that the expected annual return on a 2-year bond is 0.35% per year higher than the expected return on a series of two, 1-year bonds. What is the current market price of a 2- year bond that pays a 4% coupon rate (annual payments) and what is the expected price of this bond one year from today? If you buy the bond today, hold it for one year, collect its first coupon payment, then immediately resell it at the expected selling price, what is your expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts