Question: Please show work Net Profit Margin Operating Margin Return on Assets Return on Equity Revenue Total Cash Total Debt Current Ratio Price per share Earnings

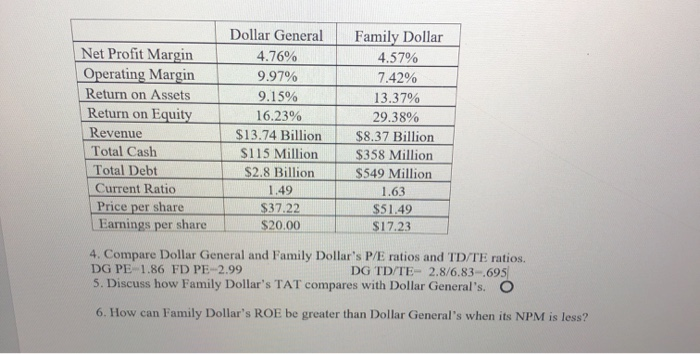

Net Profit Margin Operating Margin Return on Assets Return on Equity Revenue Total Cash Total Debt Current Ratio Price per share Earnings per share Dollar General 4.76% 9.97% 9.15% 16.23% $13.74 Billion $115 Million $2.8 Billion 1.49 $37.22 $20.00 Family Dollar 4.57% 7.42% 13.37% 29.38% $8.37 Billion $358 Million $549 Million 1.63 $51.49 $17.23 4. Compare Dollar General and Family Dollar's P/E ratios and TD/TE ratios. DG PE 1.86 FD PE-2.99 DG TD/TE- 2.8/6.83-695 5. Discuss how Family Dollar's TAT compares with Dollar General's. O 6. How can Family Dollar's ROE be greater than Dollar General's when its NPM is less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts