Question: Please show work on how you got the answer, thank you! 6. Salary expense at Slow Hand Cooker is $6,000 per week for a Tuesday-Sunday

Please show work on how you got the answer, thank you!

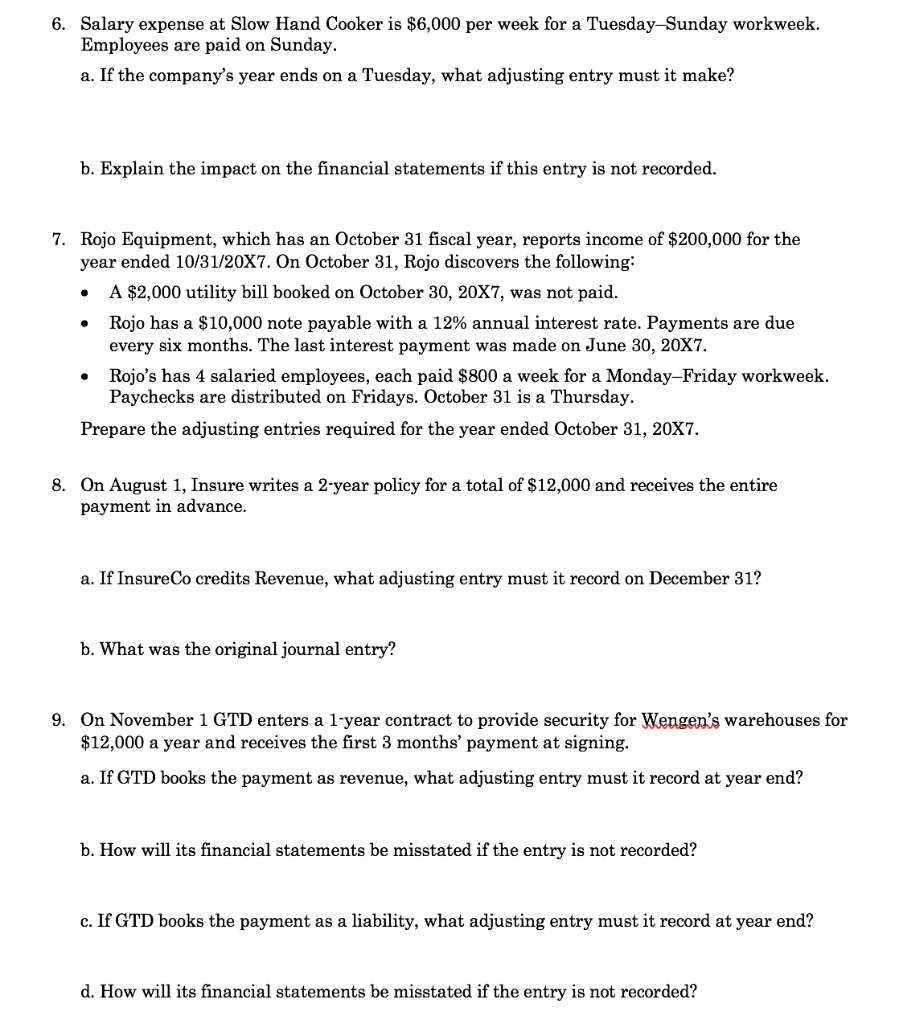

6. Salary expense at Slow Hand Cooker is $6,000 per week for a Tuesday-Sunday workweek. Employees are paid on Sunday. a. If the company's year ends on a Tuesday, what adjusting entry must it make? b. Explain the impact on the financial statements if this entry is not recorded. . . 7. Rojo Equipment, which has an October 31 fiscal year, reports income of $200,000 for the year ended 10/31/20X7. On October 31, Rojo discovers the following: A $2,000 utility bill booked on October 30, 20X7, was not paid. Rojo has a $10,000 note payable with a 12% annual interest rate. Payments are due every six months. The last interest payment was made on June 30, 20X7. Rojo's has 4 salaried employees, each paid $800 a week for a Monday-Friday workweek. Paychecks are distributed on Fridays. October 31 is a Thursday. Prepare the adjusting entries required for the year ended October 31, 20X7. 8. On August 1, Insure writes a 2-year policy for a total of $12,000 and receives the entire payment in advance. a. If InsureCo credits Revenue, what adjusting entry must it record on December 31? b. What was the original journal entry? 9. On November 1 GTD enters a 1-year contract to provide security for Wengen's warehouses for $12,000 a year and receives the first 3 months' payment at signing. a. If GTD books the payment as revenue, what adjusting entry must it record at year end? b. How will its financial statements be misstated if the entry is not recorded? c. If GTD books the payment as a liability, what adjusting entry must it record at year end? d. How will its financial statements be misstated if the entry is not recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts