Question: please show work thank you, i rate! D Question 1 0.5 pts Let's do a scenario analysis of the future stock market. We are expecting

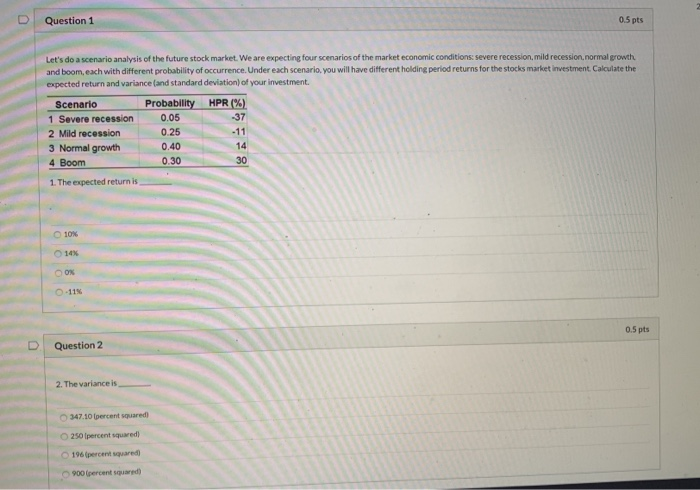

D Question 1 0.5 pts Let's do a scenario analysis of the future stock market. We are expecting four scenarios of the market economic conditions severe recession, mild recession, normal growth and boom, each with different probability of occurrence. Under each scenario, you will have different holding period returns for the stock market investment Calculate the expected return and variance and standard deviation of your investment Scenario Probability HPR (%) 1 Severe recession 0.05 -37 2 Mild recession 0.25 3 Normal growth 0.40 4 Boom 0.30 1. The expected return is 10% 0.5 pts D. Question 2 2. The variance is 347.10 percent squared 250 percent 900 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts