Question: Please show work. The down payment required for your dream home is $200,000 today. You currently have $150,000. You decide to invest your savings at

Please show work.

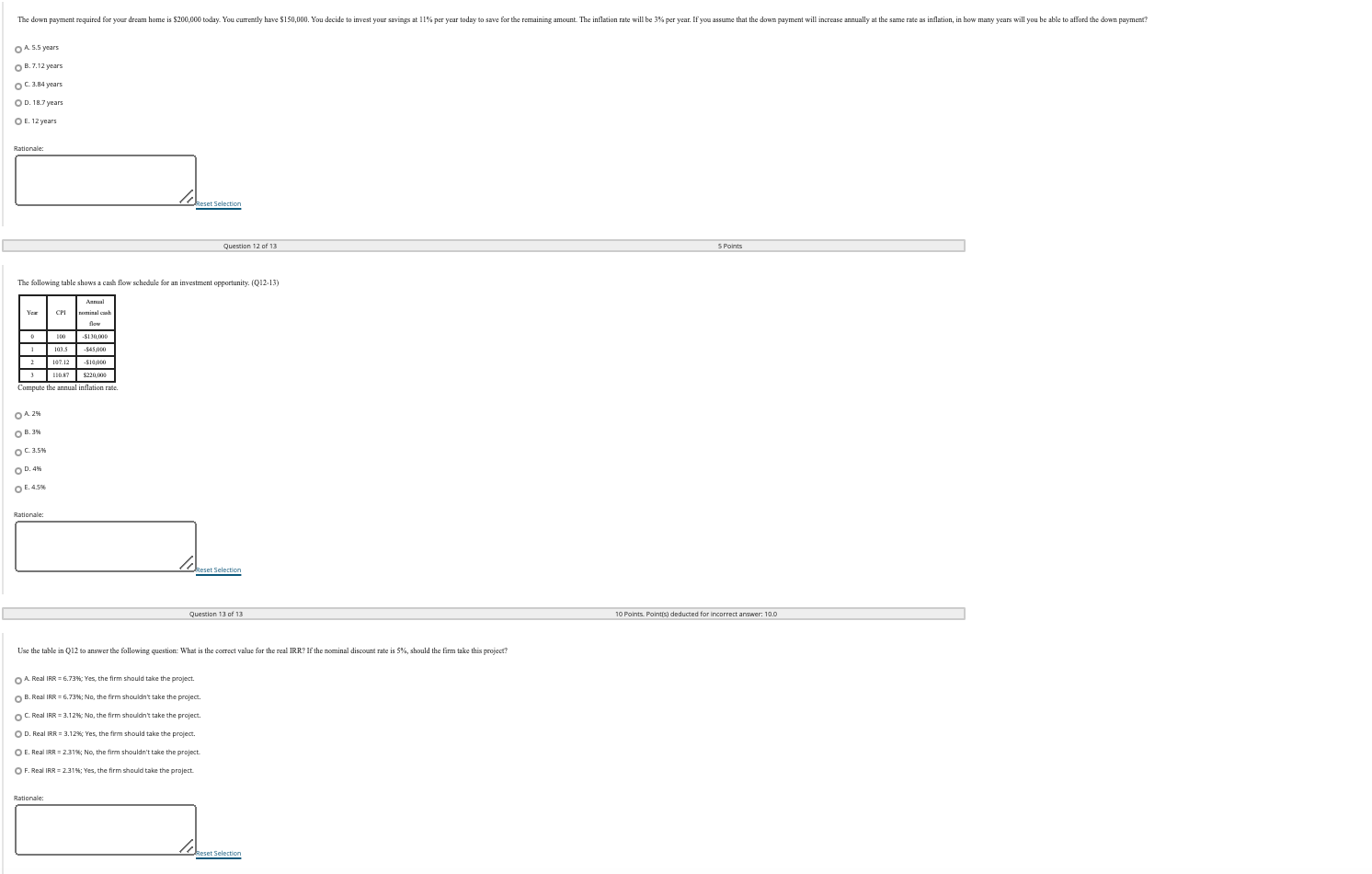

The down payment required for your dream home is $200,000 today. You currently have $150,000. You decide to invest your savings at 1 1%% per year today to save for the remaining amount. The inflation rate will be 3% per year. If you assume that the down payment will increase annually at the same rate as inflation, in how many years will you be able to afford the down payment? A 5.5 years O B. 7.12 years O C. 3.84 years O D. 18.7 years O E. 12 years Rationale: set Selection Question 12 of 13 Points The following table shows a cash flow schedule for an investment opportunity. (Q12-13) Annual Year CPI caretinal cant flew 100 -$1 30,006 103.5 -545,060 167.12 -516,060 180.87 $220,009 Compute the annual inflation rate. O B. 3% O C 3.5% O D. 4% O E. 4.56 Rationale: set Selection Question 13 of 13 10 Points. Pointis) deducted for incorrect answer: 10.0 Use the table in Q12 to answer the following question: What is the correct value for the real IRR? If the mom iscount rate is 5%, should the firm take this project? A Real IRR = 6.73%; Yes, th the project. ) B. Real IRR = 6.73%%; No, the fi C. Real IRR = 3.12%; No, the firm shouldn't take the project. O D. Real IRR = 3.12%% Yes, the firm should take the project. O E. Real IRR = 2.319%; No, the firm shouldn't talk be the project OF. Real IRR = 2.31%; Yes, the firm should take the project Rationale: set Selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts