Question: Please show worked out problems and answers. All tables are given below and each part of the question is included. mx Problem 6-49 (algorithmic) Question

Please show worked out problems and answers. All tables are given below and each part of the question is included.

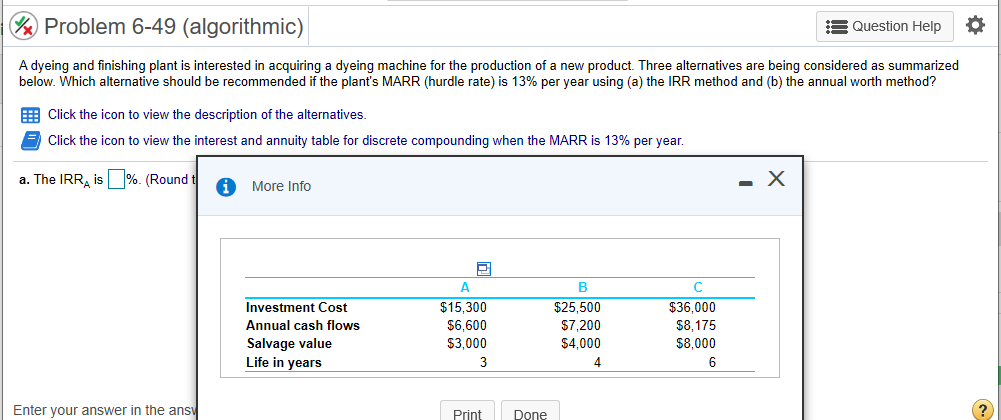

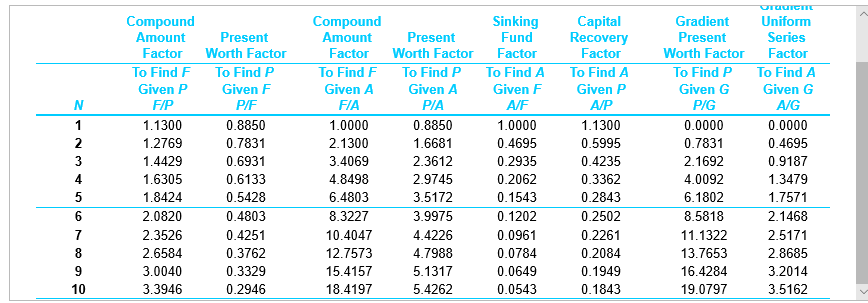

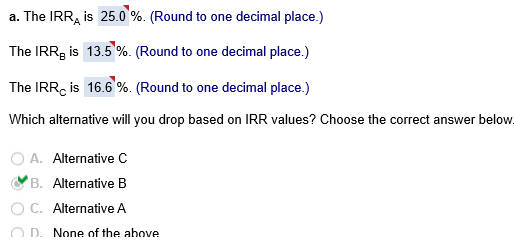

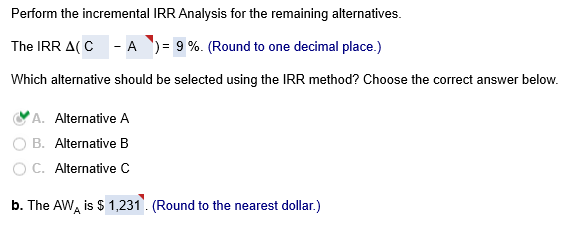

mx Problem 6-49 (algorithmic) Question Help A dyeing and finishing plant is interested in acquiring a dyeing machine for the production of a new product. Three alternatives are being considered as summarized below. Which alternative should be recommended if the plant's MARR (hurdle rate) is 13% per year using (a) the IRR method and (b) the annual worth method? Click the icon to view the description of the alternatives Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. a. The IRR is % (Round t A More Info Investment Cost Annual cash flows Salvage value Life in years $15,300 $6,600 $3,000 B $25,500 $7,200 $4,000 C $36,000 $8,175 $8,000 6 Enter your answer in the ansy Print Done Oruronic Capital Recovery Factor To Find A Given P PF A/P Compound Amount Present Factor Worth Factor To Find To Find P Given P Given F FIP 1.1300 0.8850 1.2769 0.7831 1.4429 0.6931 1.6305 0.6133 1.8424 0.5428 2.0820 0.4803 2.3526 0.4251 2.6584 0.3762 3.0040 0.3329 3.3946 0.2946 Compound Amount Factor To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 Present Worth Factor To Find P Given A P/A 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 Gradient Present Worth Factor To Find P Given G P/G 0.0000 0.7831 2.1692 4.0092 6.1802 8.5818 11.1322 13.7653 16.4284 19.0797 Uniform Series Factor To Find A Given G AIG 0.0000 0.4695 0.9187 1.3479 1.7571 2.1468 2.5171 2.8685 3.2014 3.5162 a. The IRR is 25.0 %. (Round to one decimal place.) The IRR is 13.5%. (Round to one decimal place.) The IRR is 16.6%. (Round to one decimal place.) Which alternative will you drop based on IRR values? Choose the correct answer below O A. Alternative C B. Alternative B OC. Alternative A D. None of the above Perform the incremental IRR Analysis for the remaining alternatives. The IRR AC-A ) = 9% (Round to one decimal place.) Which alternative should be selected using the IRR method? Choose the correct answer below. A. Alternative A OB. Alternative B OC. Alternative C b. The AW.is $ 1,231 (Round to the nearest dollar.) The AW, is $ -281. (Round to the nearest dollar.) The Aw is $ 409. (Round to the nearest dollar.) Which alternative should be selected using the annual worth method? Choose the correct answer below. XA. Alternative C B. Alternative A OC. Alternative B mx Problem 6-49 (algorithmic) Question Help A dyeing and finishing plant is interested in acquiring a dyeing machine for the production of a new product. Three alternatives are being considered as summarized below. Which alternative should be recommended if the plant's MARR (hurdle rate) is 13% per year using (a) the IRR method and (b) the annual worth method? Click the icon to view the description of the alternatives Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. a. The IRR is % (Round t A More Info Investment Cost Annual cash flows Salvage value Life in years $15,300 $6,600 $3,000 B $25,500 $7,200 $4,000 C $36,000 $8,175 $8,000 6 Enter your answer in the ansy Print Done Oruronic Capital Recovery Factor To Find A Given P PF A/P Compound Amount Present Factor Worth Factor To Find To Find P Given P Given F FIP 1.1300 0.8850 1.2769 0.7831 1.4429 0.6931 1.6305 0.6133 1.8424 0.5428 2.0820 0.4803 2.3526 0.4251 2.6584 0.3762 3.0040 0.3329 3.3946 0.2946 Compound Amount Factor To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 Present Worth Factor To Find P Given A P/A 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 Gradient Present Worth Factor To Find P Given G P/G 0.0000 0.7831 2.1692 4.0092 6.1802 8.5818 11.1322 13.7653 16.4284 19.0797 Uniform Series Factor To Find A Given G AIG 0.0000 0.4695 0.9187 1.3479 1.7571 2.1468 2.5171 2.8685 3.2014 3.5162 a. The IRR is 25.0 %. (Round to one decimal place.) The IRR is 13.5%. (Round to one decimal place.) The IRR is 16.6%. (Round to one decimal place.) Which alternative will you drop based on IRR values? Choose the correct answer below O A. Alternative C B. Alternative B OC. Alternative A D. None of the above Perform the incremental IRR Analysis for the remaining alternatives. The IRR AC-A ) = 9% (Round to one decimal place.) Which alternative should be selected using the IRR method? Choose the correct answer below. A. Alternative A OB. Alternative B OC. Alternative C b. The AW.is $ 1,231 (Round to the nearest dollar.) The AW, is $ -281. (Round to the nearest dollar.) The Aw is $ 409. (Round to the nearest dollar.) Which alternative should be selected using the annual worth method? Choose the correct answer below. XA. Alternative C B. Alternative A OC. Alternative B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts