Question: Please solve all parts completely: 4 Problem 4 US Parent Company A wants to finance a five-year project for its German Subsidiary B which costs

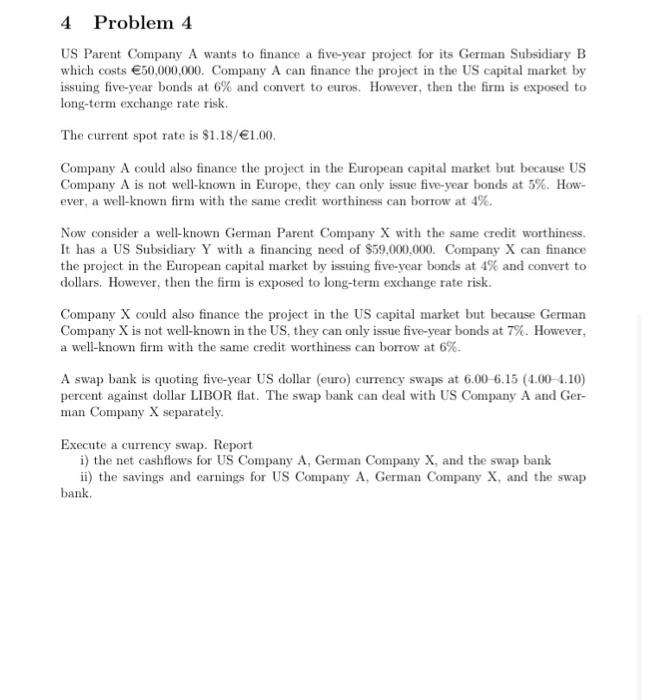

4 Problem 4 US Parent Company A wants to finance a five-year project for its German Subsidiary B which costs 50,000,000. Company A can finance the project in the US capital market by issuing five-year bonds at 6% and convert to euros. However, then the firm is exposed to long-term exchange rate risk. The current spot rate is $1.18/1.00. Company A could also finance the project in the European capital market but because US Company A is not well-known in Europe, they can only issue five-year bonds at 5%. How- ever, a well-known firm with the same credit worthiness can borrow at 4%. Now consider a well-known German Parent Company X with the same credit worthiness. It has a US Subsidiary Y with a financing need of $59,000,000. Company X can finance the project in the European capital market by issuing five-year bonds at 4% and convert to dollars. However, then the firm is exposed to long-term exchange rate risk. Company X could also finance the project in the US capital market but because German Company X is not well-known in the US, they can only issue five-year bonds at 7%. However, a well-known firm with the same credit worthiness can borrow at 6%. A swap bank is quoting five-year US dollar (euro) currency swaps at 6.00-6.15 (4.00 4.10) percent against dollar LIBOR flat. The swap bank can deal with US Company A and Ger- man Company X separately. Execute a currency swap. Report i) the net cashflows for US Company A, German Company X, and the swap bank ii) the savings and earnings for US Company A, German Company X, and the swap bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts