Question: Short Answer: Boeing just signed a contract to sell a Boeing 747 aircraft to Air France. Air France will be billed 100 million, which is

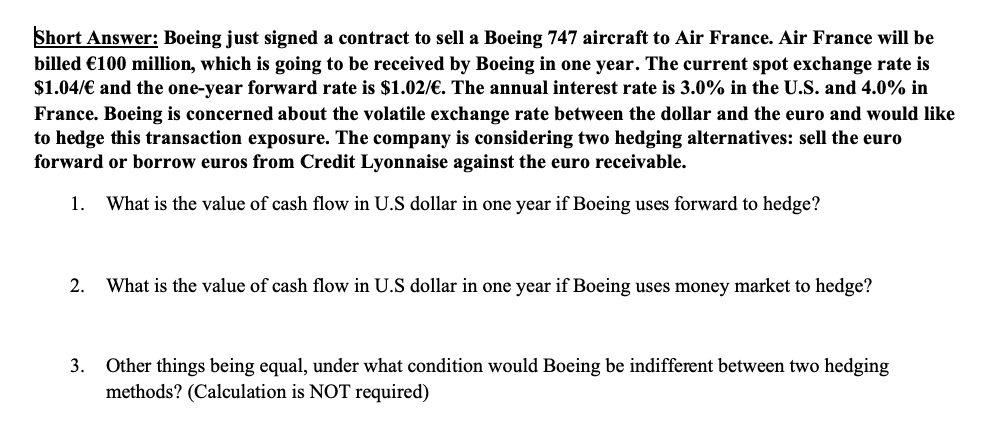

Short Answer: Boeing just signed a contract to sell a Boeing 747 aircraft to Air France. Air France will be billed 100 million, which is going to be received by Boeing in one year. The current spot exchange rate is $1.04/ and the one-year forward rate is $1.02/. The annual interest rate is 3.0% in the U.S. and 4.0% in France. Boeing is concerned about the volatile exchange rate between the dollar and the euro and would like to hedge this transaction exposure. The company is considering two hedging alternatives: sell the euro forward or borrow euros from Credit Lyonnaise against the euro receivable. 1. What is the value of cash flow in U.S dollar in one year if Boeing uses forward to hedge? 2. What is the value of cash flow in U.S dollar in one year if Boeing uses money market to hedge? 3. Other things being equal, under what condition would Boeing be indifferent between two hedging methods? (Calculation is NOT required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts