Question: please solve and explain Question 7 (10 points) Stephen J. Kennel TV Production is considering producing a pilot for a comedy series in the hope

please solve and explain

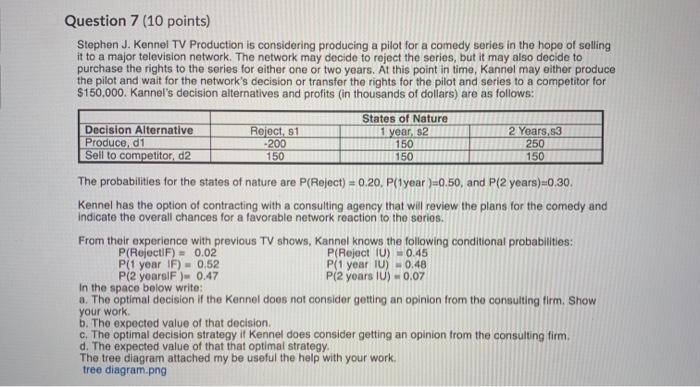

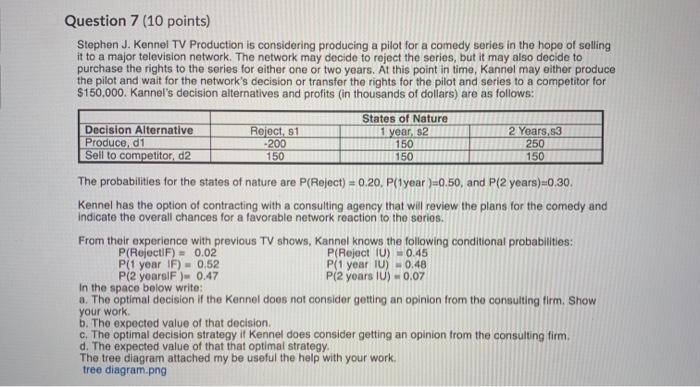

Question 7 (10 points) Stephen J. Kennel TV Production is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Kannel may either produce the pilot and wait for the network's decision or transfer the rights for the pilot and series to a competitor for S150.000. Kannel's decision alternatives and profits (in thousands of dollars) are as follows: States of Nature Decision Alternative Reject, s1 1 year s2 2 Years,53 Produce, d1 -200 150 250 Sell to competitor, d2 150 150 150 The probabilities for the states of nature are P(Reject) = 0.20. P(1year )=0.50, and P(2 years)=0.30. Kennel has the option of contracting with a consulting agency that will review the plans for the comedy and Indicate the overall chances for a favorable network reaction to the series. From their experience with previous TV shows, Kannel knows the following conditional probabilities: P(Reject|F) = 0.02 P(Reject (U) - 0.45 P(1 year F) = 0.52 P(1 year IU) -0.48 Pi2 yearsIF ) - 0.47 P(2 years IU) - 0.07 In the space below write: a. The optimal decision if the Kennel does not consider getting an opinion from the consulting firm. Show your work b. The expected value of that decision. C. The optimal decision strategy it Kennel does consider getting an opinion from the consulting firm, d. The expected value of that that optimal strategy The tree diagram attached my be useful the help with your work. tree diagram.png Question 7 (10 points) Stephen J. Kennel TV Production is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Kannel may either produce the pilot and wait for the network's decision or transfer the rights for the pilot and series to a competitor for S150.000. Kannel's decision alternatives and profits (in thousands of dollars) are as follows: States of Nature Decision Alternative Reject, s1 1 year s2 2 Years,53 Produce, d1 -200 150 250 Sell to competitor, d2 150 150 150 The probabilities for the states of nature are P(Reject) = 0.20. P(1year )=0.50, and P(2 years)=0.30. Kennel has the option of contracting with a consulting agency that will review the plans for the comedy and Indicate the overall chances for a favorable network reaction to the series. From their experience with previous TV shows, Kannel knows the following conditional probabilities: P(Reject|F) = 0.02 P(Reject (U) - 0.45 P(1 year F) = 0.52 P(1 year IU) -0.48 Pi2 yearsIF ) - 0.47 P(2 years IU) - 0.07 In the space below write: a. The optimal decision if the Kennel does not consider getting an opinion from the consulting firm. Show your work b. The expected value of that decision. C. The optimal decision strategy it Kennel does consider getting an opinion from the consulting firm, d. The expected value of that that optimal strategy The tree diagram attached my be useful the help with your work. tree diagram.png

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock