Question: Please solve and show your work. Please include formula and how you got to the answer. Please include reasoning. As a financial manager of Firm

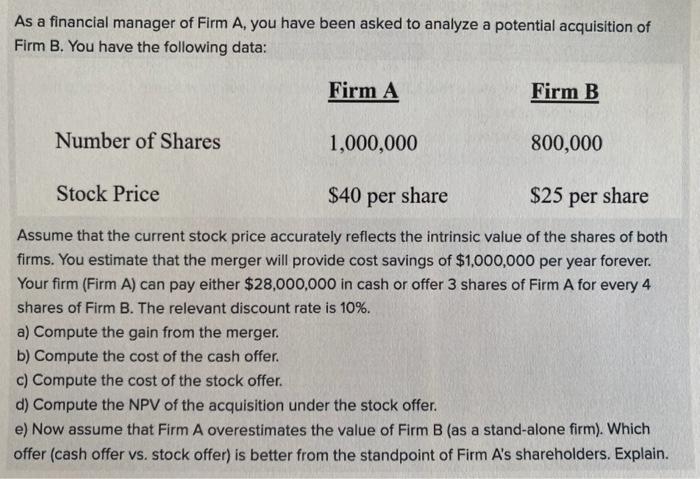

As a financial manager of Firm A, you have been asked to analyze a potential acquisition of Firm B. You have the following data: Firm A Firm B Number of Shares 1,000,000 800,000 Stock Price $40 per share $25 per share Assume that the current stock price accurately reflects the intrinsic value of the shares of both firms. You estimate that the merger will provide cost savings of $1,000,000 per year forever. Your firm (Firm A) can pay either $28,000,000 in cash or offer 3 shares of Firm A for every 4 shares of Firm B. The relevant discount rate is 10%. a) Compute the gain from the merger. b) Compute the cost of the cash offer. c) Compute the cost of the stock offer. d) Compute the NPV of the acquisition under the stock offer. e) Now assume that Firm A overestimates the value of Firm B (as a stand-alone firm). Which offer (cash offer vs. stock offer) is better from the standpoint of Firm A's shareholders. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts