Question: Please solve and show your work thank you :) Instructions Show all calcolatices in detail. No partial credit will be given for juste 1) Assume

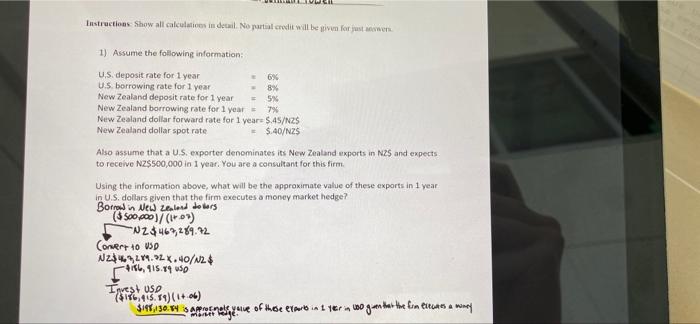

Instructions Show all calcolatices in detail. No partial credit will be given for juste 1) Assume the following information: U.S. deposit rate for 1 year 6% U.S. borrowing rate for 1 year 8% New Zealand deposit rate for 1 year 5X New Zealand borrowing rate for 1 year 7% New Zealand dollar forward rate for 1 year 5.45/N2$ New Zealand dollar spot rate = $.40/NZS Also assume that a U.S. exporter denominates its New Zealand exports in NS and expects to receive NZ$500,000 in 1 year. You are a consultant for this firm. Using the information above, what will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a money market hedge? Borrow in New Zealand deters (5 500 000)/(1+0) N2 $46,289.72 Convert to USD N264219.92.40/24 [" 4166, 115.19 05 Invest USD ($176.43.14) (1+06) $147,136.94 Sandve of those ever beint vermogen der the firm its a winny

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts