Question: please solve as soon as possible T(T) is a single individual taxpayer. T was hired by company X(X) on January 1 , of 2020 .

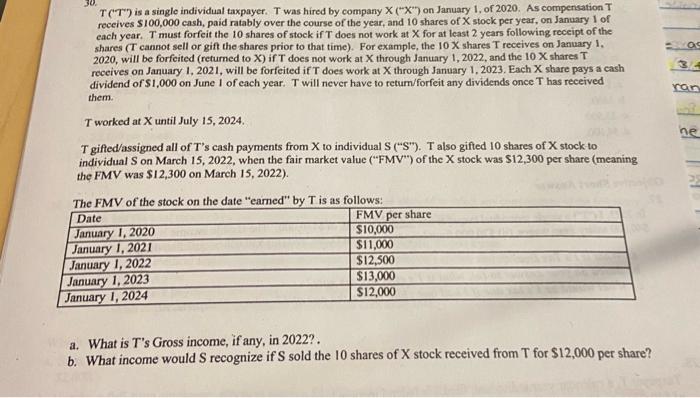

T(T) is a single individual taxpayer. T was hired by company X(X) on January 1 , of 2020 . As compensation T receives $100,000 cash, paid ratably over the course of the year, and 10 shares of X stock per year, on January 1 of each year. T must forfeit the 10 shares of stock if T does not work at X for at least 2 years following receipt of the shares (T cannot sell or gift the shares prior to that time). For example, the 10X shares T receives on January 1. 2020 , will be forfcited (returned to X ) if T does not work at X through January 1,2022 , and the 10X shares T receives on January 1, 2021, will be forfeited if T does work at X through January 1, 2023. Each X share pays a cash dividend of $1,000 on June I of each year. T will never have to return/forfeit any dividends once T has received them. T worked at X until July 15, 2024. T gifted/assigned all of T 's cash payments from X to individual S (" S). T also gifted 10 shares of X stock-to individual S on March 15, 2022, when the fair market value ("FMV") of the X stock was S12,300 per share (meaning the FMV was \$12,300 on March 15, 2022). a. What is T's Gross income, if any, in 2022?. b. What income would S recognize if S sold the 10 shares of X stock received from T for $12,000 per share? T(T) is a single individual taxpayer. T was hired by company X(X) on January 1 , of 2020 . As compensation T receives $100,000 cash, paid ratably over the course of the year, and 10 shares of X stock per year, on January 1 of each year. T must forfeit the 10 shares of stock if T does not work at X for at least 2 years following receipt of the shares (T cannot sell or gift the shares prior to that time). For example, the 10X shares T receives on January 1. 2020 , will be forfcited (returned to X ) if T does not work at X through January 1,2022 , and the 10X shares T receives on January 1, 2021, will be forfeited if T does work at X through January 1, 2023. Each X share pays a cash dividend of $1,000 on June I of each year. T will never have to return/forfeit any dividends once T has received them. T worked at X until July 15, 2024. T gifted/assigned all of T 's cash payments from X to individual S (" S). T also gifted 10 shares of X stock-to individual S on March 15, 2022, when the fair market value ("FMV") of the X stock was S12,300 per share (meaning the FMV was \$12,300 on March 15, 2022). a. What is T's Gross income, if any, in 2022?. b. What income would S recognize if S sold the 10 shares of X stock received from T for $12,000 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts