Question: T( T ) is a single individual taxpayer. T was hired by company X (X) on January 1 , of 2020 . As compensation

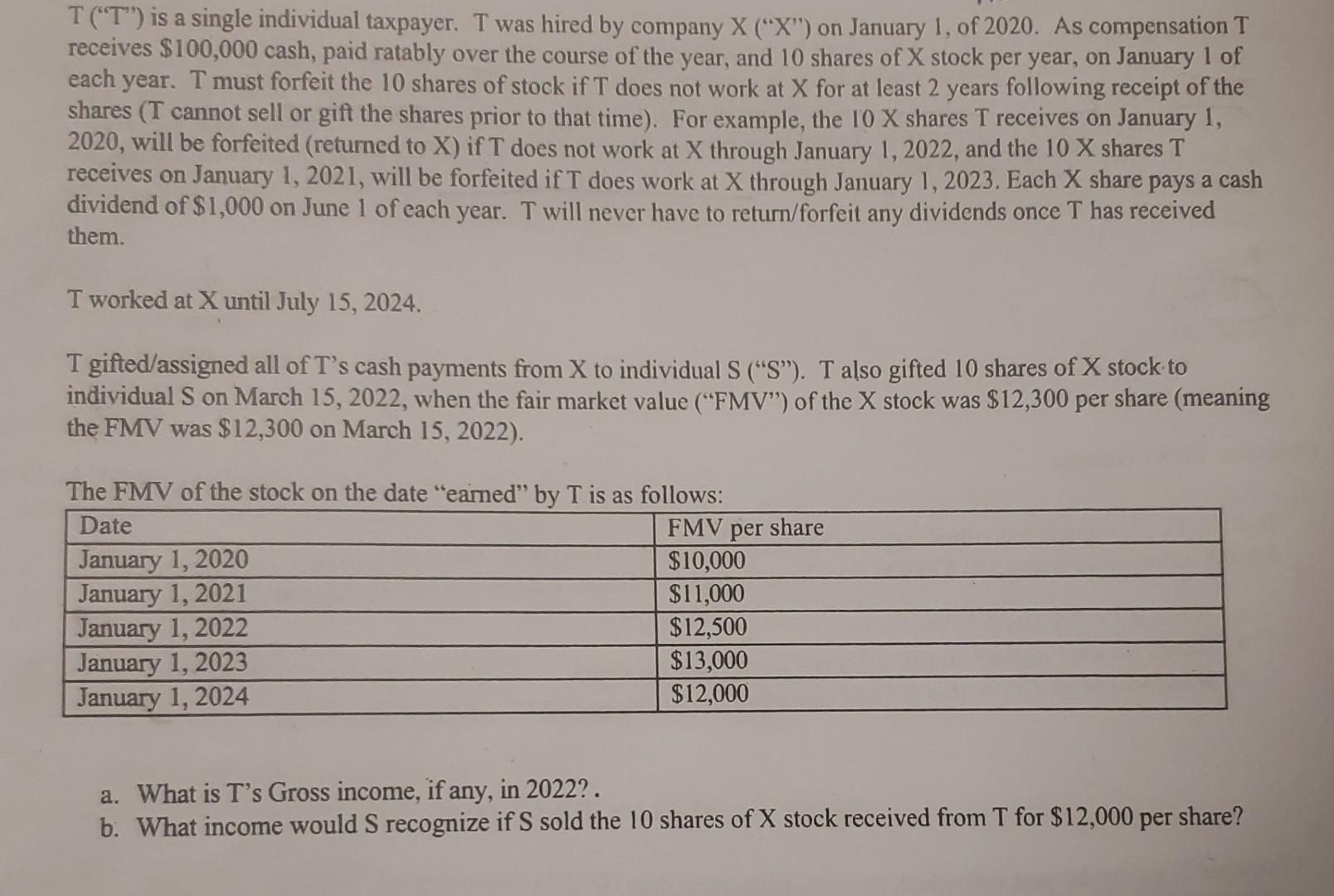

T( " T ") is a single individual taxpayer. T was hired by company X ("X") on January 1 , of 2020 . As compensation T receives $100,000 cash, paid ratably over the course of the year, and 10 shares of X stock per year, on January 1 of each year. T must forfeit the 10 shares of stock if T does not work at X for at least 2 years following receipt of the shares ( T cannot sell or gift the shares prior to that time). For example, the 10X shares T receives on January 1 , 2020 , will be forfeited (returned to X ) if T does not work at X through January 1,2022 , and the 10X shares T receives on January 1, 2021, will be forfeited if T does work at X through January 1, 2023. Each X share pays a cash dividend of $1,000 on June 1 of each year. T will never have to return/forfeit any dividends once T has received them. T worked at X until July 15,2024. T gifted/assigned all of T's cash payments from X to individual S ("S"). T also gifted 10 shares of X stock to individual S on March 15, 2022, when the fair market value ("FMV") of the X stock was $12,300 per share (meaning the FMV was $12,300 on March 15,2022). The FMV of the stock on the date "eamed" bv T is as follows: a. What is T's Gross income, if any, in 2022?. b. What income would S recognize if S sold the 10 shares of X stock received from T for $12,000 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts