Question: Please solve ASAP! I will leave a thumbs up!! DrinksOnUs Inc. wants to expand its product offerings with a new non-alcoholic drink mix at a

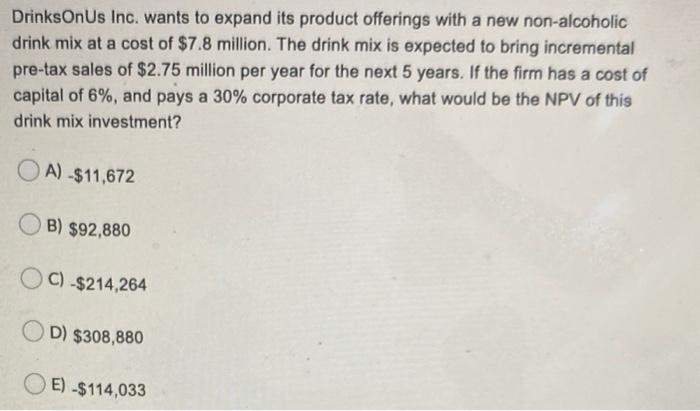

DrinksOnUs Inc. wants to expand its product offerings with a new non-alcoholic drink mix at a cost of $7.8 million. The drink mix is expected to bring incremental pre-tax sales of $2.75 million per year for the next 5 years. If the firm has a cost of capital of 6%, and pays a 30% corporate tax rate, what would be the NPV of this drink mix investment? OA) -$11,672 B) $92,880 C) -$214,264 D) $308,880 OE) -$114,033

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts