Question: please solve completely and i need the solutions asap plz nd thanks A helicopter is to be purchased by Autopilot Airlines for $700,000. The helicopter

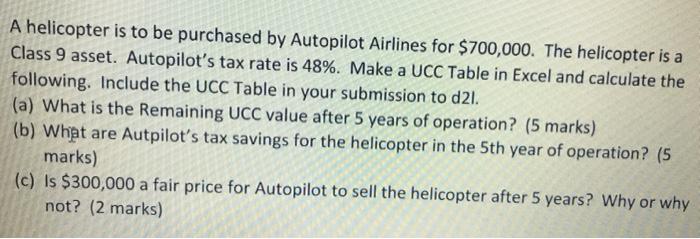

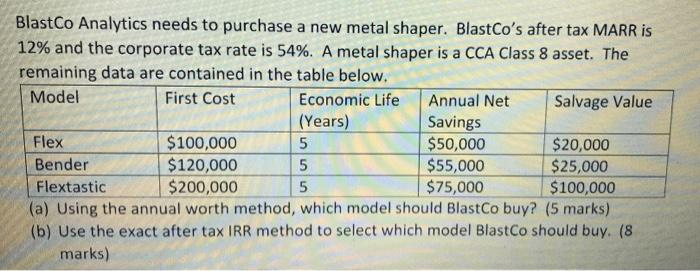

A helicopter is to be purchased by Autopilot Airlines for $700,000. The helicopter is a Class 9 asset. Autopilot's tax rate is 48%. Make a UCC Table in Excel and calculate the following. Include the UCC Table in your submission to d21. (a) What is the Remaining UCC value after 5 years of operation? (5 marks) (b) What are Autpilot's tax savings for the helicopter in the 5th year of operation? (5 marks) (c) Is $300,000 a fair price for Autopilot to sell the helicopter after 5 years? Why or why not? (2 marks) BlastCo Analytics needs to purchase a new metal shaper. BlastCo's after tax MARR is 12% and the corporate tax rate is 54%. A metal shaper is a CCA Class 8 asset. The remaining data are contained in the table below. Model First Cost Economic Life Annual Net Salvage Value (Years) Savings Flex $100,000 5 $50,000 $20,000 Bender $120,000 5 $55,000 $25,000 Flextastic $200,000 5 $75,000 $100,000 (a) Using the annual worth method, which model should BlastCo buy? (5 marks) (b) Use the exact after tax IRR method to select which model BlastCo should buy. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts