Question: please solve fast i will thumb you up Suppose you sell short 100 shares of stock initially selling for $100 a share. Your initial margin

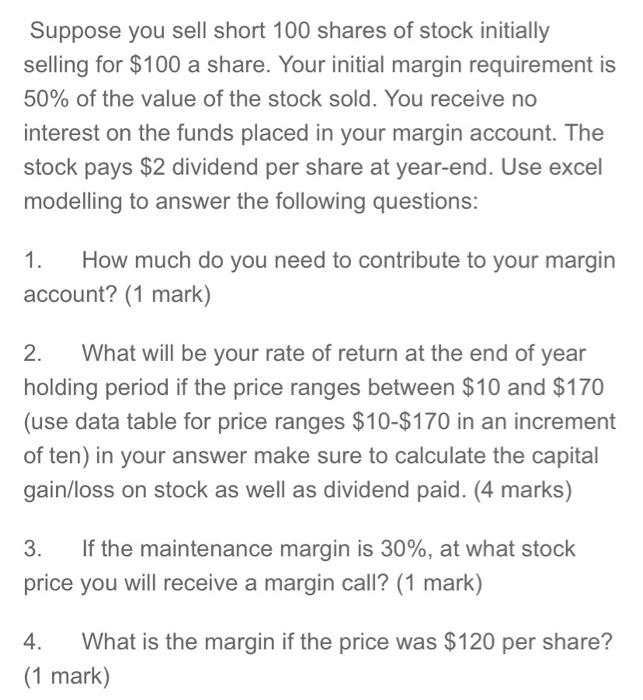

Suppose you sell short 100 shares of stock initially selling for $100 a share. Your initial margin requirement is 50% of the value of the stock sold. You receive no interest on the funds placed in your margin account. The stock pays $2 dividend per share at year-end. Use excel modelling to answer the following questions: 1. How much do you need to contribute to your margin account? (1 mark) 2. What will be your rate of return at the end of year holding period if the price ranges between $10 and $170 (use data table for price ranges $10-$170 in an increment of ten) in your answer make sure to calculate the capital gain/loss on stock as well as dividend paid. (4 marks) 3. If the maintenance margin is 30%, at what stock price you will receive a margin call? (1 mark) 4. What is the margin if the price was $120 per share? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts