Question: Please solve for A and B Please show your work. Please explain your reasoning. An investor buys a 6-month European call option with an exercise

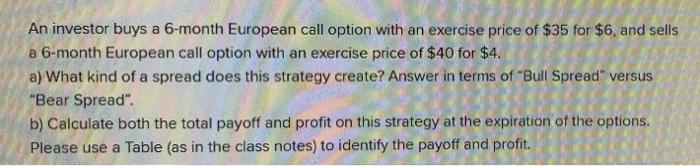

An investor buys a 6-month European call option with an exercise price of $35 for $6 and sells a 6-month European call option with an exercise price of $40 for $4. a) What kind of a spread does this strategy create? Answer in terms of "Bull Spread" versus "Bear Spread". b) Calculate both the total payoff and profit on this strategy at the expiration of the options. Please use a Table (as in the class notes) to identify the payoff and profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts