Question: please solve in excel format and give a thorough explanation estimated sales: 600 units @ avg. sells $ per of $80 S&A EXPENSES BUDGET %

please solve in excel format and give a thorough explanation

estimated sales: 600 units @ avg. sells $ per of $80

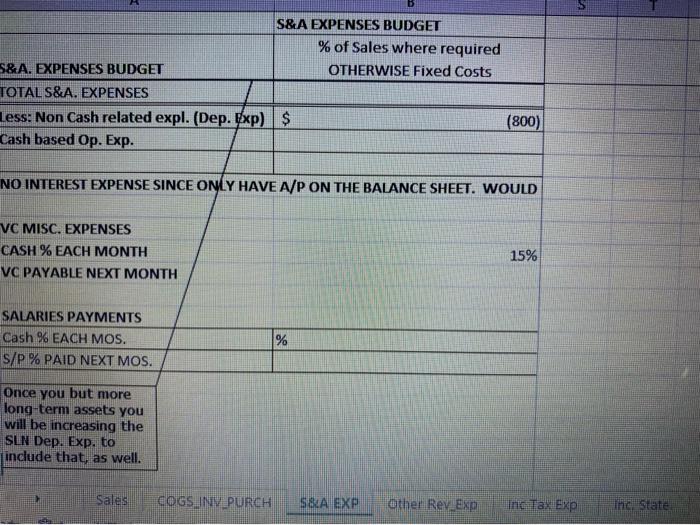

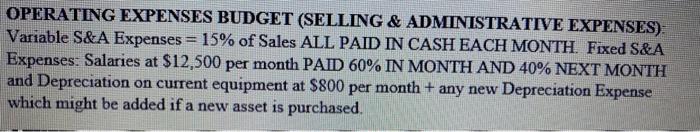

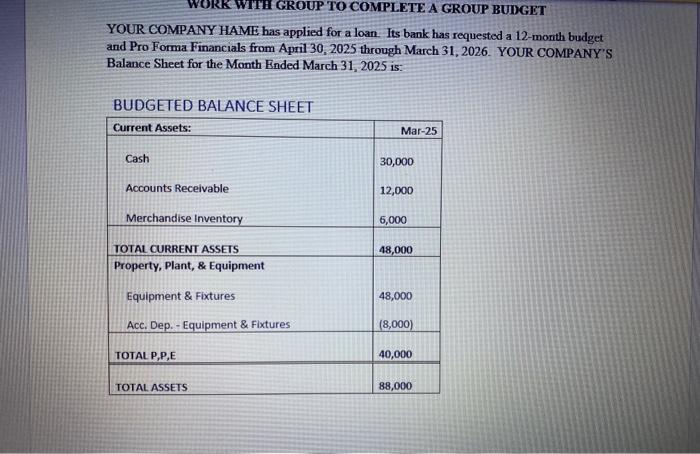

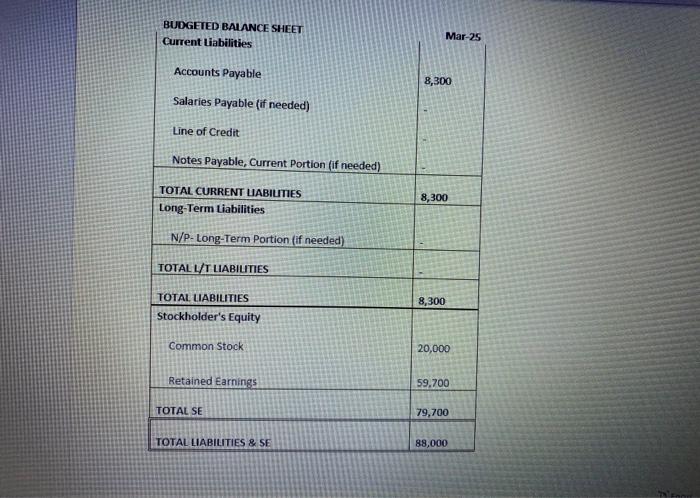

S&A EXPENSES BUDGET % of Sales where required S&A. EXPENSES BUDGET OTHERWISE Fixed Costs TOTALS&A. EXPENSES less: Non Cash related expl. (Dep. Exp) $ (800) Cash based Op. Exp. NO INTEREST EXPENSE SINCE ONLY HAVE A/P ON THE BALANCE SHEET. WOULD VC MISC. EXPENSES CASH % EACH MONTH VC PAYABLE NEXT MONTH 15% SALARIES PAYMENTS Cash 96 EACH MOS. S/P % PAID NEXT MOS. % Once you but more long-term assets you will be increasing the SLN Dep. Exp. to include that, as well. Sales COGS.INVPURCH 58A EXP Other Rev Exp Inc Tax Exp the State OPERATING EXPENSES BUDGET (SELLING & ADMINISTRATIVE EXPENSES): Variable S&A Expenses = 15% of Sales ALL PAID IN CASH EACH MONTH. Fixed S&A Expenses: Salaries at $12,500 per month PAID 60% IN MONTH AND 40% NEXT MONTH and Depreciation on current equipment at $800 per month + any new Depreciation Expense which might be added if a new asset is purchased. WORK WITH GROUP TO COMPLETE A GROUP BUDGET YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 BUDGETED BALANCE SHEET Current liabilities Mar-25 Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) TOTAL CURRENT LIABILITIES Long-Term Liabilities 8,300 N/P- Long-Term Portion (if needed) TOTALL/T LIABILITIES TOTAL LIABILITIES Stockholder's Equity 8,300 Common Stock 20,000 Retained Earnings 59.700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000 S&A EXPENSES BUDGET % of Sales where required S&A. EXPENSES BUDGET OTHERWISE Fixed Costs TOTALS&A. EXPENSES less: Non Cash related expl. (Dep. Exp) $ (800) Cash based Op. Exp. NO INTEREST EXPENSE SINCE ONLY HAVE A/P ON THE BALANCE SHEET. WOULD VC MISC. EXPENSES CASH % EACH MONTH VC PAYABLE NEXT MONTH 15% SALARIES PAYMENTS Cash 96 EACH MOS. S/P % PAID NEXT MOS. % Once you but more long-term assets you will be increasing the SLN Dep. Exp. to include that, as well. Sales COGS.INVPURCH 58A EXP Other Rev Exp Inc Tax Exp the State OPERATING EXPENSES BUDGET (SELLING & ADMINISTRATIVE EXPENSES): Variable S&A Expenses = 15% of Sales ALL PAID IN CASH EACH MONTH. Fixed S&A Expenses: Salaries at $12,500 per month PAID 60% IN MONTH AND 40% NEXT MONTH and Depreciation on current equipment at $800 per month + any new Depreciation Expense which might be added if a new asset is purchased. WORK WITH GROUP TO COMPLETE A GROUP BUDGET YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 BUDGETED BALANCE SHEET Current liabilities Mar-25 Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) TOTAL CURRENT LIABILITIES Long-Term Liabilities 8,300 N/P- Long-Term Portion (if needed) TOTALL/T LIABILITIES TOTAL LIABILITIES Stockholder's Equity 8,300 Common Stock 20,000 Retained Earnings 59.700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts