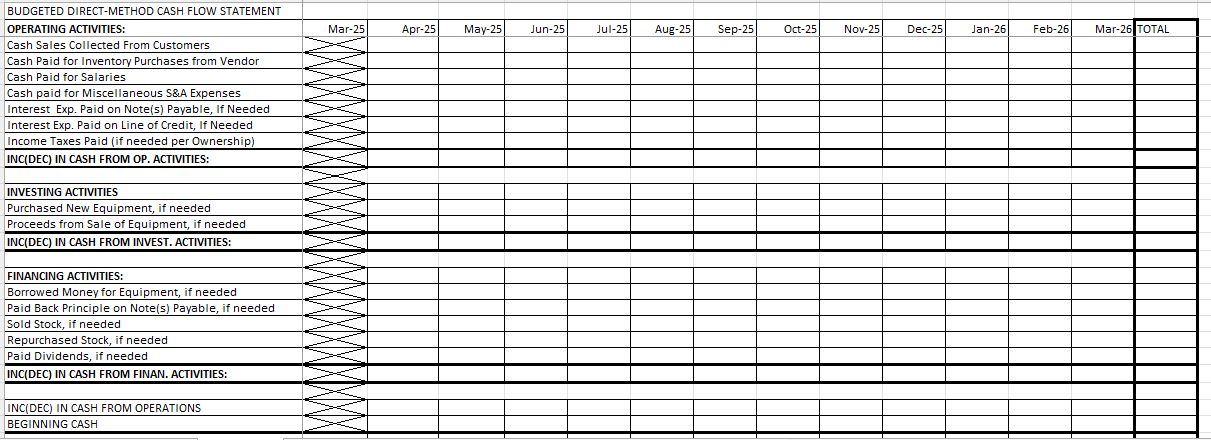

Question: please solve using excel format Mar-29 Apr-25 May-25 Jun-25 Jul-251 Aug-25 Sep-251 Oct-25 Nov-25 Dec-25 Jan-261 Feb-26 Mar-26 TOTAL BUDGETED DIRECT-METHOD CASH FLOW STATEMENT OPERATING

please solve using excel format

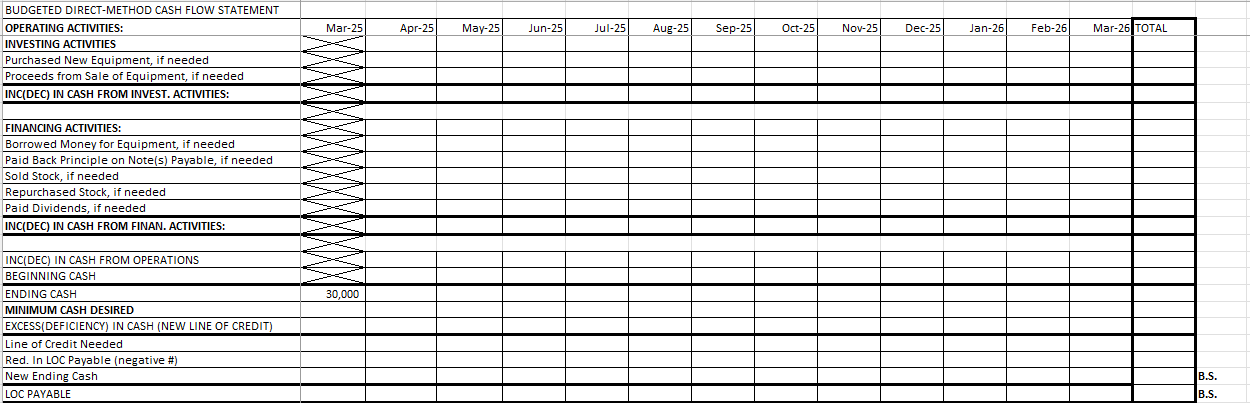

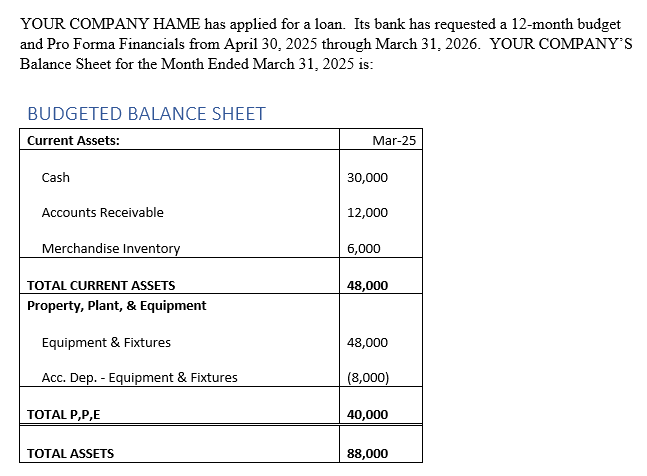

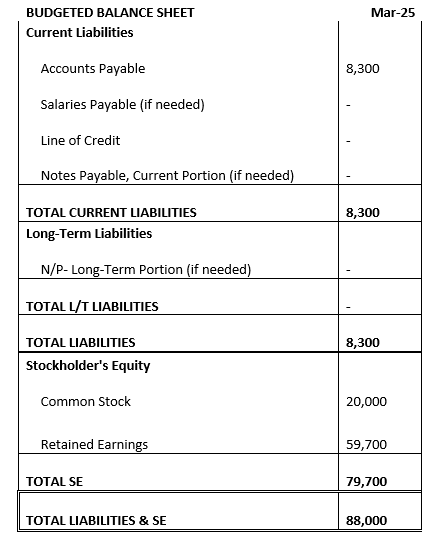

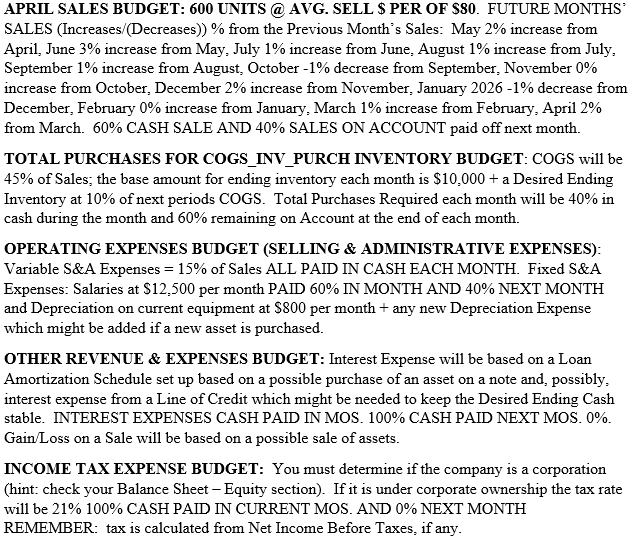

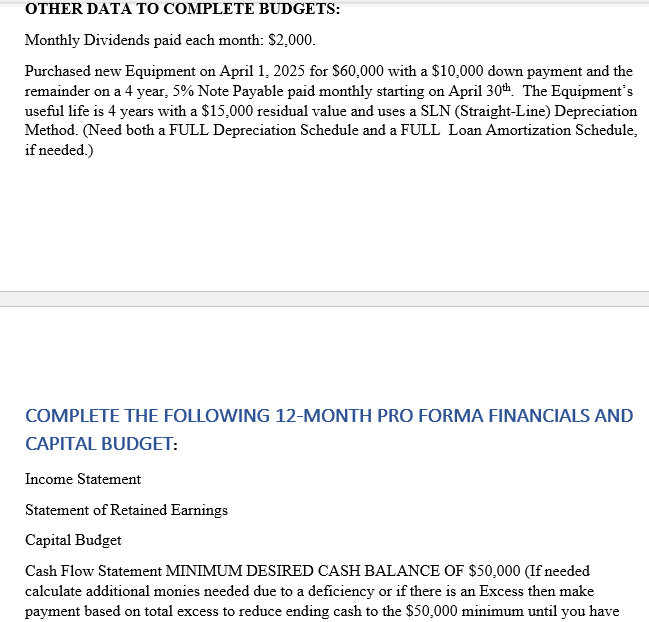

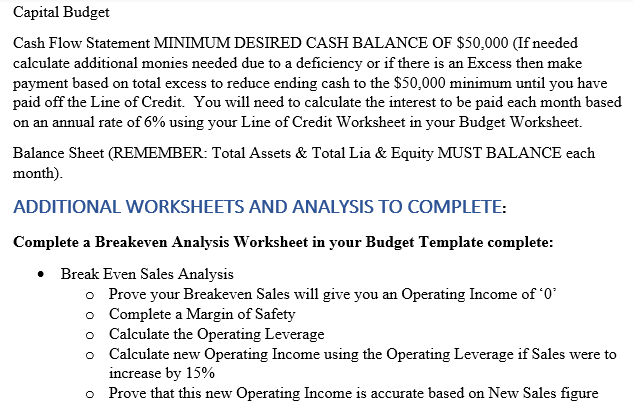

Mar-29 Apr-25 May-25 Jun-25 Jul-251 Aug-25 Sep-251 Oct-25 Nov-25 Dec-25 Jan-261 Feb-26 Mar-26 TOTAL BUDGETED DIRECT-METHOD CASH FLOW STATEMENT OPERATING ACTIVITIES: Cash Sales Collected From Customers Cash Paid for Inventory Purchases from Vendor Cash Paid for Salaries Cash paid for Miscellaneous S&A Expenses Interest Exp. Paid on Note(s) Payable, If Needed Interest Exp. Paid on Line of Credit, If Needed Income Taxes Paid (if needed per Ownership) INC(DEC) IN CASH FROM OP. ACTIVITIES: INVESTING ACTIVITIES Purchased New Equipment, if needed Proceeds from Sale of Equipment, if needed INC(DEC) IN CASH FROM INVEST.ACTIVITIES: FINANCING ACTIVITIES: Borrowed Money for Equipment, if needed Paid Back Principle on Note(s) Payable, if needed Sold Stock, if needed Repurchased Stock, if needed Paid Dividends, if needed INC(DEC) IN CASH FROM FINAN. ACTIVITIES: INCIDEC) IN CASH FROM OPERATIONS BEGINNING CASH Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 TOTAL BUDGETED DIRECT-METHOD CASH FLOW STATEMENT OPERATING ACTIVITIES: INVESTING ACTIVITIES Purchased New Equipment, if needed Proceeds from Sale of Equipment, if needed INC(DEC) IN CASH FROM INVEST.ACTIVITIES: FINANCING ACTIVITIES: Borrowed Money for Equipment, if needed Paid Back Principle on Note(s) Payable, if needed Sold Stock, if needed Repurchased Stock, if needed Paid Dividends, if needed INC(DEC) IN CASH FROM FINAN. ACTIVITIES: 30,000 INCIDEC) IN CASH FROM OPERATIONS BEGINNING CASH ENDING CASH MINIMUM CASH DESIRED EXCESS(DEFICIENCY) IN CASH (NEW LINE OF CREDIT) Line of Credit Needed Red. In LOC Payable (negative #) New Ending Cash LOC PAYABLE B.S. B.S. YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 Mar-25 BUDGETED BALANCE SHEET Current Liabilities Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) 8,300 TOTAL CURRENT LIABILITIES Long-Term Liabilities N/P-Long-Term Portion (if needed) TOTAL L/T LIABILITIES 8,300 TOTAL LIABILITIES Stockholder's Equity Common Stock 20,000 Retained Earnings 59,700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000 APRIL SALES BUDGET: 600 UNITS @ AVG. SELL $ PER OF $80. FUTURE MONTHS SALES (Increases/(Decreases)) % from the Previous Month's Sales: May 2% increase from April, June 3% increase from May, July 1% increase from June. August 1% increase from July, September 1% increase from August, October -1% decrease from September. November 0% increase from October, December 2% increase from November, January 2026 -1% decrease from December, February 0% increase from January, March 1% increase from February, April 2% from March. 60% CASH SALE AND 40% SALES ON ACCOUNT paid off next month. TOTAL PURCHASES FOR COGS_INV_PURCH INVENTORY BUDGET: COGS will be 45% of Sales; the base amount for ending inventory each month is $10,000 + a Desired Ending Inventory at 10% of next periods COGS. Total Purchases Required each month will be 40% in cash during the month and 60% remaining on Account at the end of each month. OPERATING EXPENSES BUDGET (SELLING & ADMINISTRATIVE EXPENSES): Variable S&A Expenses = 15% of Sales ALL PAID IN CASH EACH MONTH. Fixed S&A Expenses: Salaries at $12,500 per month PAID 60% IN MONTH AND 40% NEXT MONTH and Depreciation on current equipment at $800 per month + any new Depreciation Expense which might be added if a new asset is purchased. OTHER REVENUE & EXPENSES BUDGET: Interest Expense will be based on a Loan Amortization Schedule set up based on a possible purchase of an asset on a note and possibly, interest expense from a Line of Credit which might be needed to keep the Desired Ending Cash stable. INTEREST EXPENSES CASH PAID IN MOS. 100% CASH PAID NEXT MOS. 0%. Gain Loss on a Sale will be based on a possible sale of assets. INCOME TAX EXPENSE BUDGET: You must determine if the company is a corporation (hint: check your Balance Sheet - Equity section). If it is under corporate ownership the tax rate will be 21% 100% CASH PAID IN CURRENT MOS. AND 0% NEXT MONTH REMEMBER: tax is calculated from Net Income Before Taxes, if any. OTHER DATA TO COMPLETE BUDGETS: Monthly Dividends paid each month: $2.000. Purchased new Equipment on April 1, 2025 for $60.000 with a $10,000 down payment and the remainder on a 4 year, 5% Note Payable paid monthly starting on April 30th The Equipment's useful life is 4 years with a $15,000 residual value and uses a SLN (Straight-Line) Depreciation Method. (Need both a FULL Depreciation Schedule and a FULL Loan Amortization Schedule, if needed.) COMPLETE THE FOLLOWING 12-MONTH PRO FORMA FINANCIALS AND CAPITAL BUDGET: Income Statement Statement of Retained Earnings Capital Budget Cash Flow Statement MINIMUM DESIRED CASH BALANCE OF $50,000 (If needed calculate additional monies needed due to a deficiency or if there is an Excess then make payment based on total excess to reduce ending cash to the $50,000 minimum until you have Capital Budget Cash Flow Statement MINIMUM DESIRED CASH BALANCE OF $50,000 (If needed calculate additional monies needed due to a deficiency or if there is an Excess then make payment based on total excess to reduce ending cash to the $50,000 minimum until you have paid off the Line of Credit. You will need to calculate the interest to be paid each month based on an annual rate of 6% using your Line of Credit Worksheet in your Budget Worksheet. Balance Sheet (REMEMBER: Total Assets & Total Lia & Equity MUST BALANCE each month). ADDITIONAL WORKSHEETS AND ANALYSIS TO COMPLETE: Complete a Breakeven Analysis Worksheet in your Budget Template complete: Break Even Sales Analysis o Prove your Breakeven Sales will give you an Operating Income of 'o' o Complete a Margin of Safety o Calculate the Operating Leverage o Calculate new Operating Income using the Operating Leverage if Sales were to increase by 15% o Prove that this new Operating Income is accurate based on New Sales figure O Mar-29 Apr-25 May-25 Jun-25 Jul-251 Aug-25 Sep-251 Oct-25 Nov-25 Dec-25 Jan-261 Feb-26 Mar-26 TOTAL BUDGETED DIRECT-METHOD CASH FLOW STATEMENT OPERATING ACTIVITIES: Cash Sales Collected From Customers Cash Paid for Inventory Purchases from Vendor Cash Paid for Salaries Cash paid for Miscellaneous S&A Expenses Interest Exp. Paid on Note(s) Payable, If Needed Interest Exp. Paid on Line of Credit, If Needed Income Taxes Paid (if needed per Ownership) INC(DEC) IN CASH FROM OP. ACTIVITIES: INVESTING ACTIVITIES Purchased New Equipment, if needed Proceeds from Sale of Equipment, if needed INC(DEC) IN CASH FROM INVEST.ACTIVITIES: FINANCING ACTIVITIES: Borrowed Money for Equipment, if needed Paid Back Principle on Note(s) Payable, if needed Sold Stock, if needed Repurchased Stock, if needed Paid Dividends, if needed INC(DEC) IN CASH FROM FINAN. ACTIVITIES: INCIDEC) IN CASH FROM OPERATIONS BEGINNING CASH Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 TOTAL BUDGETED DIRECT-METHOD CASH FLOW STATEMENT OPERATING ACTIVITIES: INVESTING ACTIVITIES Purchased New Equipment, if needed Proceeds from Sale of Equipment, if needed INC(DEC) IN CASH FROM INVEST.ACTIVITIES: FINANCING ACTIVITIES: Borrowed Money for Equipment, if needed Paid Back Principle on Note(s) Payable, if needed Sold Stock, if needed Repurchased Stock, if needed Paid Dividends, if needed INC(DEC) IN CASH FROM FINAN. ACTIVITIES: 30,000 INCIDEC) IN CASH FROM OPERATIONS BEGINNING CASH ENDING CASH MINIMUM CASH DESIRED EXCESS(DEFICIENCY) IN CASH (NEW LINE OF CREDIT) Line of Credit Needed Red. In LOC Payable (negative #) New Ending Cash LOC PAYABLE B.S. B.S. YOUR COMPANY HAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets: Mar-25 Cash 30,000 Accounts Receivable 12,000 Merchandise Inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48,000 Acc. Dep. - Equipment & Fixtures (8,000) TOTAL P,P,E 40,000 TOTAL ASSETS 88,000 Mar-25 BUDGETED BALANCE SHEET Current Liabilities Accounts Payable 8,300 Salaries Payable (if needed) Line of Credit Notes Payable, Current Portion (if needed) 8,300 TOTAL CURRENT LIABILITIES Long-Term Liabilities N/P-Long-Term Portion (if needed) TOTAL L/T LIABILITIES 8,300 TOTAL LIABILITIES Stockholder's Equity Common Stock 20,000 Retained Earnings 59,700 TOTAL SE 79,700 TOTAL LIABILITIES & SE 88,000 APRIL SALES BUDGET: 600 UNITS @ AVG. SELL $ PER OF $80. FUTURE MONTHS SALES (Increases/(Decreases)) % from the Previous Month's Sales: May 2% increase from April, June 3% increase from May, July 1% increase from June. August 1% increase from July, September 1% increase from August, October -1% decrease from September. November 0% increase from October, December 2% increase from November, January 2026 -1% decrease from December, February 0% increase from January, March 1% increase from February, April 2% from March. 60% CASH SALE AND 40% SALES ON ACCOUNT paid off next month. TOTAL PURCHASES FOR COGS_INV_PURCH INVENTORY BUDGET: COGS will be 45% of Sales; the base amount for ending inventory each month is $10,000 + a Desired Ending Inventory at 10% of next periods COGS. Total Purchases Required each month will be 40% in cash during the month and 60% remaining on Account at the end of each month. OPERATING EXPENSES BUDGET (SELLING & ADMINISTRATIVE EXPENSES): Variable S&A Expenses = 15% of Sales ALL PAID IN CASH EACH MONTH. Fixed S&A Expenses: Salaries at $12,500 per month PAID 60% IN MONTH AND 40% NEXT MONTH and Depreciation on current equipment at $800 per month + any new Depreciation Expense which might be added if a new asset is purchased. OTHER REVENUE & EXPENSES BUDGET: Interest Expense will be based on a Loan Amortization Schedule set up based on a possible purchase of an asset on a note and possibly, interest expense from a Line of Credit which might be needed to keep the Desired Ending Cash stable. INTEREST EXPENSES CASH PAID IN MOS. 100% CASH PAID NEXT MOS. 0%. Gain Loss on a Sale will be based on a possible sale of assets. INCOME TAX EXPENSE BUDGET: You must determine if the company is a corporation (hint: check your Balance Sheet - Equity section). If it is under corporate ownership the tax rate will be 21% 100% CASH PAID IN CURRENT MOS. AND 0% NEXT MONTH REMEMBER: tax is calculated from Net Income Before Taxes, if any. OTHER DATA TO COMPLETE BUDGETS: Monthly Dividends paid each month: $2.000. Purchased new Equipment on April 1, 2025 for $60.000 with a $10,000 down payment and the remainder on a 4 year, 5% Note Payable paid monthly starting on April 30th The Equipment's useful life is 4 years with a $15,000 residual value and uses a SLN (Straight-Line) Depreciation Method. (Need both a FULL Depreciation Schedule and a FULL Loan Amortization Schedule, if needed.) COMPLETE THE FOLLOWING 12-MONTH PRO FORMA FINANCIALS AND CAPITAL BUDGET: Income Statement Statement of Retained Earnings Capital Budget Cash Flow Statement MINIMUM DESIRED CASH BALANCE OF $50,000 (If needed calculate additional monies needed due to a deficiency or if there is an Excess then make payment based on total excess to reduce ending cash to the $50,000 minimum until you have Capital Budget Cash Flow Statement MINIMUM DESIRED CASH BALANCE OF $50,000 (If needed calculate additional monies needed due to a deficiency or if there is an Excess then make payment based on total excess to reduce ending cash to the $50,000 minimum until you have paid off the Line of Credit. You will need to calculate the interest to be paid each month based on an annual rate of 6% using your Line of Credit Worksheet in your Budget Worksheet. Balance Sheet (REMEMBER: Total Assets & Total Lia & Equity MUST BALANCE each month). ADDITIONAL WORKSHEETS AND ANALYSIS TO COMPLETE: Complete a Breakeven Analysis Worksheet in your Budget Template complete: Break Even Sales Analysis o Prove your Breakeven Sales will give you an Operating Income of 'o' o Complete a Margin of Safety o Calculate the Operating Leverage o Calculate new Operating Income using the Operating Leverage if Sales were to increase by 15% o Prove that this new Operating Income is accurate based on New Sales figure O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts