Question: please solve in excel showing the work You plan to invest $500 per month for the next five years in a mutual fund averaging an

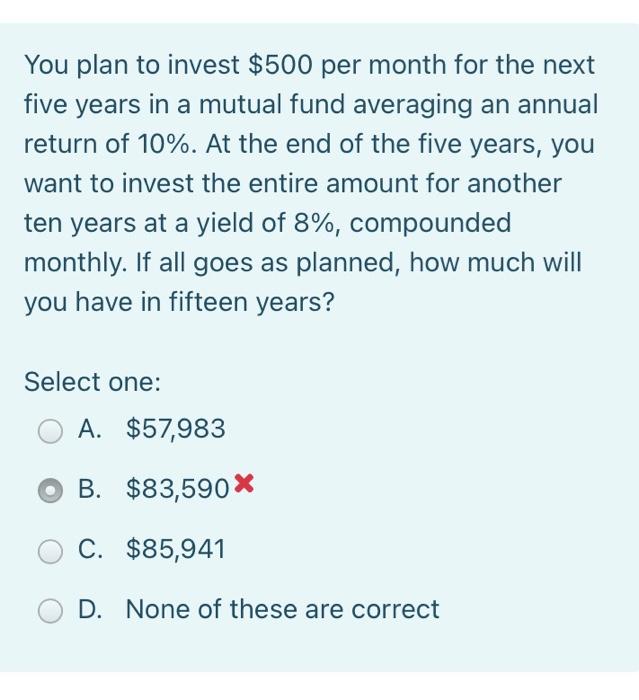

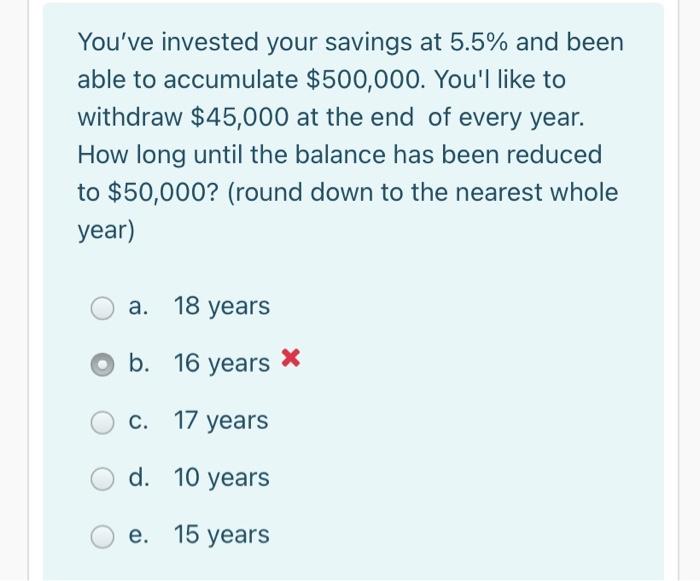

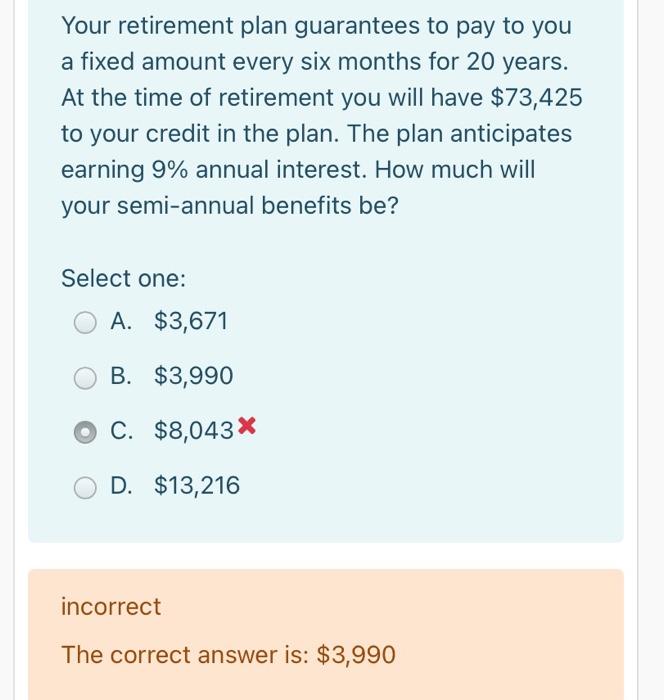

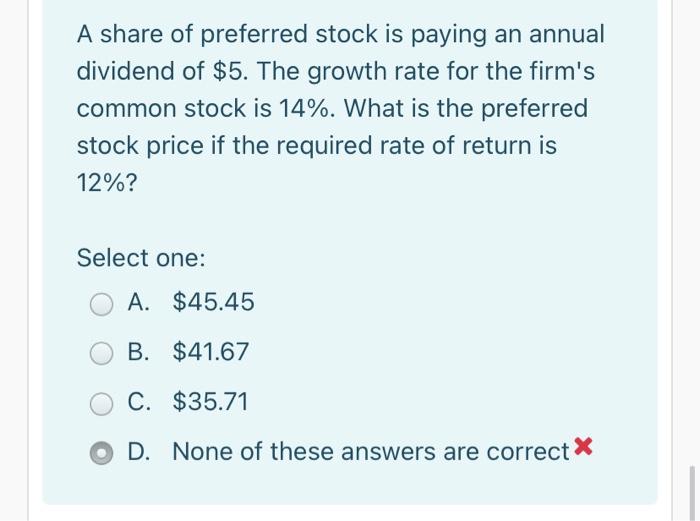

You plan to invest $500 per month for the next five years in a mutual fund averaging an annual return of 10%. At the end of the five years, you want to invest the entire amount for another ten years at a yield of 8%, compounded monthly. If all goes as planned, how much will you have in fifteen years? Select one: A. $57,983 B. $83,590% C. $85,941 D. None of these are correct You've invested your savings at 5.5% and been able to accumulate $500,000. You'l like to withdraw $45,000 at the end of every year. How long until the balance has been reduced to $50,000? (round down to the nearest whole year) a. 18 years b. 16 years * C. 17 years d. 10 years e. 15 years Your retirement plan guarantees to pay to you a fixed amount every six months for 20 years. At the time of retirement you will have $73,425 to your credit in the plan. The plan anticipates earning 9% annual interest. How much will your semi-annual benefits be? Select one: A. $3,671 O B. $3,990 C. $8,043* D. $13,216 incorrect The correct answer is: $3,990 A share of preferred stock is paying an annual dividend of $5. The growth rate for the firm's common stock is 14%. What is the preferred stock price if the required rate of return is 12%? Select one: A. $45.45 B. $41.67 C. $35.71 D. None of these answers are correct *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts