Question: please solve it in 10 mins I will thumb you up please I have 10 mins only Question 24 1 points Save Answer (1 point)

please solve it in 10 mins I will thumb you up please I have 10 mins only

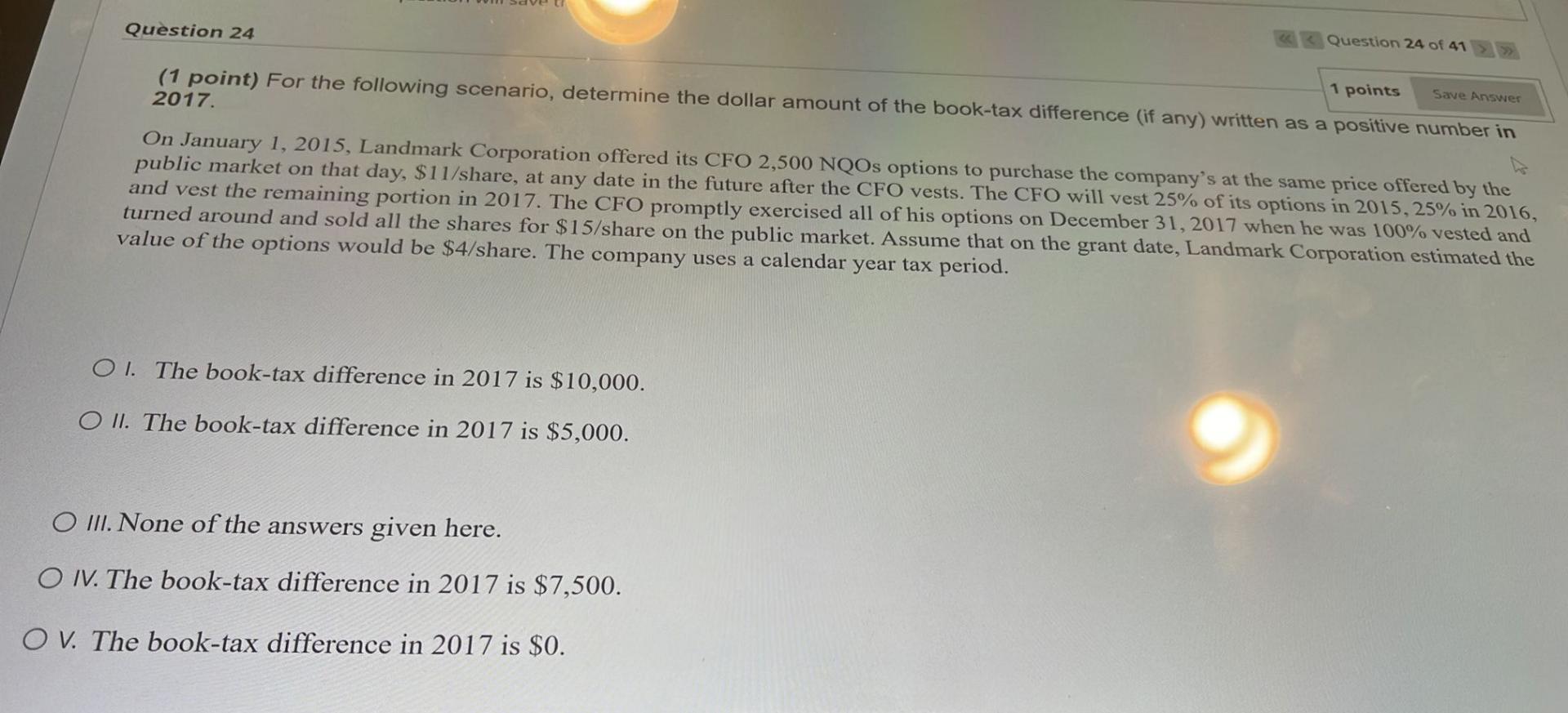

Question 24 1 points Save Answer (1 point) For the following scenario, determine the dollar amount of the book-tax difference (if any) written as a positive number in 2017. On January 1, 2015, Landmark Corporation offered its CFO 2,500 NQOs options to purchase the company's at the same price offered by the public market on that day, $11/share, at any date in the future after the CFO vests. The CFO will vest 25% of its options in 2015, 25% in 2016, and vest the remaining portion in 2017. The CFO promptly exercised all of his options on December 31, 2017 when he was 100% vested and turned around and sold all the shares for $15/share on the public market. Assume that on the grant date, Landmark Corporation estimated the value of the options would be $4/share. The company uses a calendar year tax period. OI. The book-tax difference in 2017 is $10,000. O II. The book-tax difference in 2017 is $5,000. Question 24 of 41 O III. None of the answers given here. O IV. The book-tax difference in 2017 is $7,500. OV. The book-tax difference in 2017 is $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts