Question: Please solve it manually using formula don't use excel shortcuts.Thank you Problem 6-16: Ganapati Weaving Mills is planning to automate the weaving mills. New Replacement

Please solve it manually using formula don't use excel shortcuts.Thank you

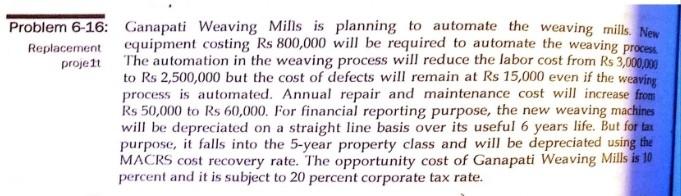

Problem 6-16: Ganapati Weaving Mills is planning to automate the weaving mills. New Replacement equipment costing Rs 800,000 will be required to automate the weaving process projet The automation in the weaving process will reduce the labor cost from Rs 3,000,000 to Rs 2,500,000 but the cost of defects will remain at Rs 15,000 even if the weaving process is automated. Annual repair and maintenance cost will increase from Rs 50,000 to Rs 60,000. For financial reporting purpose, the new weaving machines will be depreciated on a straight line basis over its useful 6 years life. But for tan purpose, it falls into the 5-year property class and will be depreciated using the MACRS cost recovery rate. The opportunity cost of Ganapati Weaving Mills is 10 percent and it is subject to 20 percent corporate tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts