Question: please solve on page only part c 2. In this question any Greek letters a, 3.7, 8, e refer to the digits of your student

please solve on page only part c

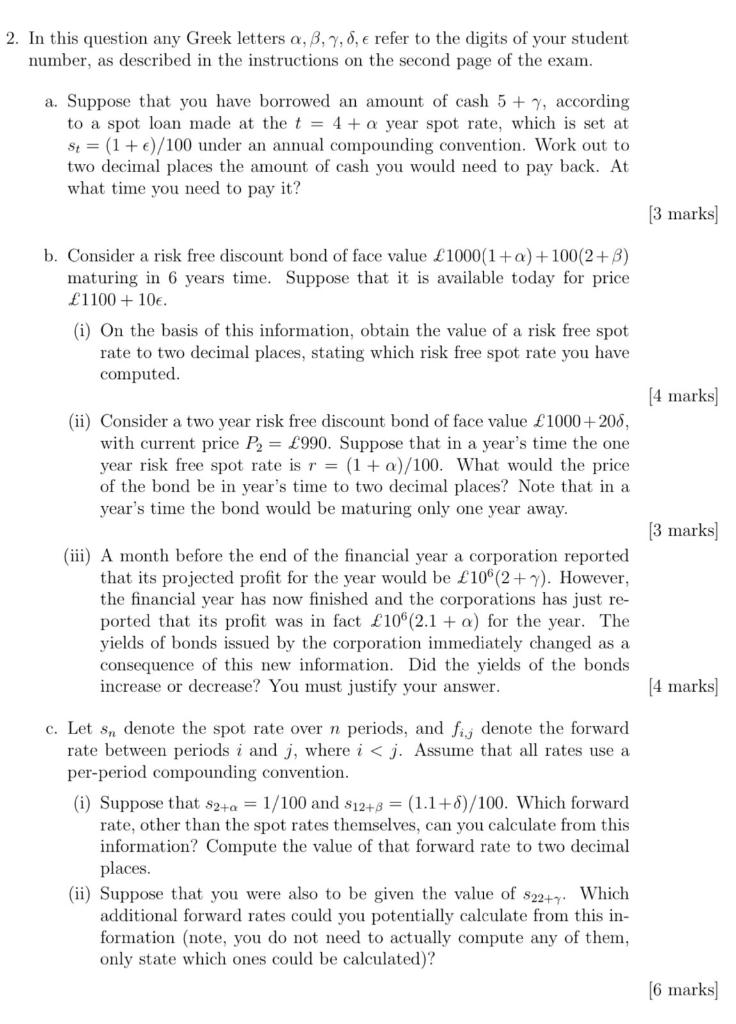

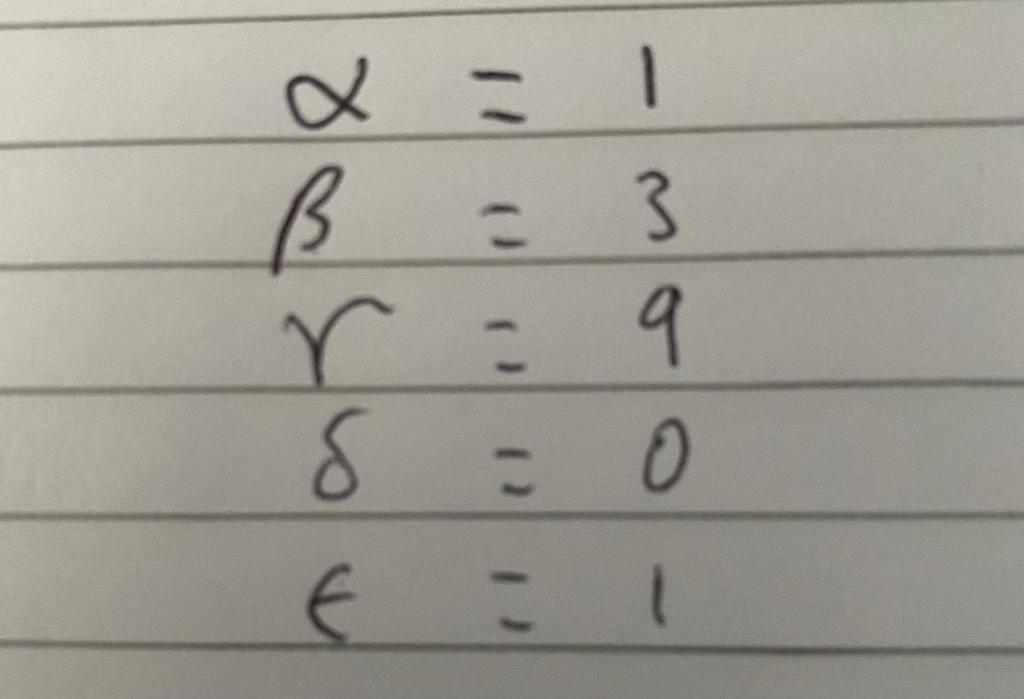

2. In this question any Greek letters a, 3.7, 8, e refer to the digits of your student number, as described in the instructions on the second page of the exam. a. Suppose that you have borrowed an amount of cash 5+7, according to a spot loan made at the t = 4 + a year spot rate, which is set at St = (1 + )/100 under an annual compounding convention. Work out to two decimal places the amount of cash you would need to pay back. At what time you need to pay it? [3 marks) b. Consider a risk free discount bond of face value 1000(1+a) +100(2+B) maturing in 6 years time. Suppose that it is available today for price 1100 + 10. (i) On the basis of this information, obtain the value of a risk free spot rate to two decimal places, stating which risk free spot rate you have computed. (4 marks] (ii) Consider a two year risk free discount bond of face value 1000+208, with current price P, = 990. Suppose that in a year's time the one year risk free spot rate is r = (1 + a)/100. What would the price of the bond be in year's time to two decimal places? Note that in a year's time the bond would be maturing only one year away. [3 marks] (iii) A month before the end of the financial year a corporation reported that its projected profit for the year would be 10 (2+2). However, the financial year has now finished and the corporations has just re- ported that its profit was in fact 10% (2.1 + a) for the year. The yields of bonds issued by the corporation immediately changed as a consequence of this new information. Did the yields of the bonds increase or decrease? You must justify your answer. [4 marks) c. Let Sn denote the spot rate over n periods, and fi, denote the forward rate between periods i and j, where i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts