Question: please solve : - please use the same format when solving the problem. - show on excel - show work - show formulas -explain Thank

please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

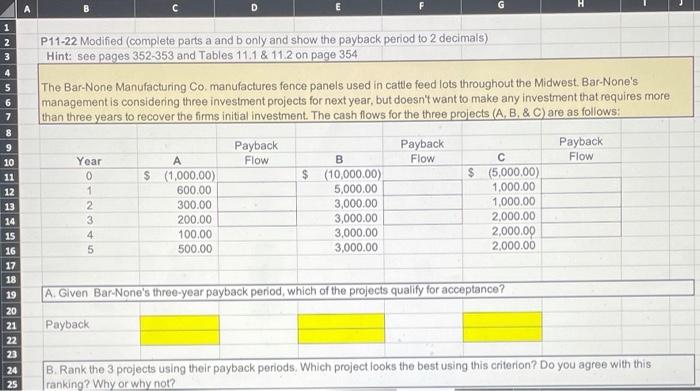

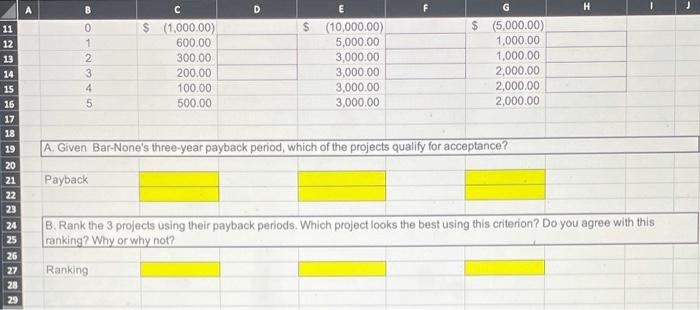

G H 1 2 P11-22 Modified (complete parts a and b only and show the payback period to 2 decimals) Hint: see pages 352-353 and Tables 11.1 & 11.2 on page 354 4 5 The Bar-None Manufacturing Co manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year, but doesn't want to make any investment that requires more than three years to recover the firms initial investment. The cash flows for the three projects (A, B, & C) are as follows: Payback Flow Payback Flow Payback Flow 8 9 10 11 12 13 Year 0 1 2 3 4 5 A $ (1.000.00) 600.00 300.00 200.00 100.00 500.00 B $ (10,000.00) 5,000.00 3,000.00 3,000.00 3,000.00 3,000.00 $ (5,000.00) 1,000.00 1,000.00 2,000.00 2,000.00 2,000.00 14 15 A. Given Bar None's three-year payback period, which of the projects qualify for acceptance? 16 17 18 19 20 21 22 23 24 25 Payback B. Rank the 3 projects using their payback periods. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? B D F G 12 CANO $ (1,000.00) 600.00 300.00 200,00 100.00 500.00 2 3 4 5 E (10,000.00) 5,000.00 3,000.00 3,000.00 3,000.00 3,000.00 $ (5,000.00) 1,000.00 1,000.00 2,000.00 2,000.00 2,000.00 14 ANASASARNAS 16 17 18 A. Given Bar-None's three-year payback period, which of the projects qualify for acceptance? Payback 21 22 23 24 25 26 27 B. Rank the 3 projects using their payback periods. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? Ranking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts