Question: please solve Question 46. Q42 is only for reference. LO6 permum ut iwan area. 14.46 ROI and RI *** Refer to the information supplied in

please solve Question 46. Q42 is only for reference.

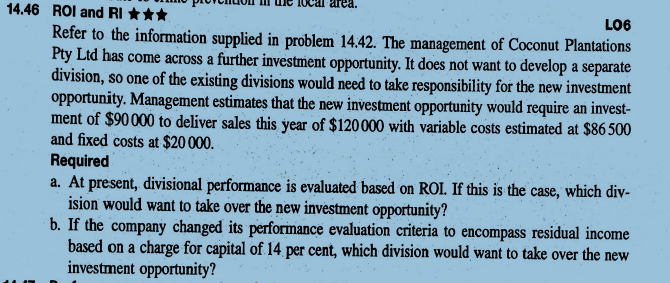

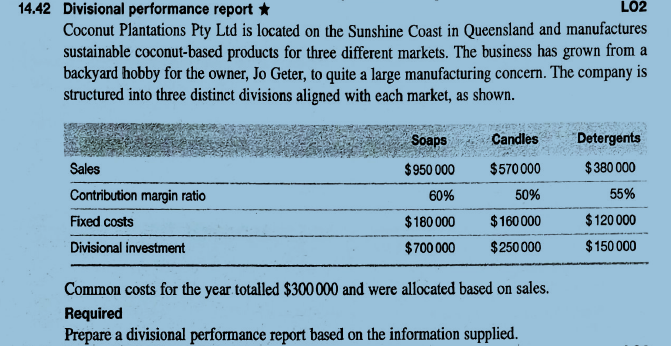

LO6 permum ut iwan area. 14.46 ROI and RI *** Refer to the information supplied in problem 14.42. The management of Coconut Plantations Pty Ltd has come across a further investment opportunity. It does not want to develop a separate division, so one of the existing divisions would need to take responsibility for the new investment opportunity. Management estimates that the new investment opportunity would require an invest- ment of $90 000 to deliver sales this year of $120000 with variable costs estimated at $86 500 and fixed costs at $20 000. Required a. At present, divisional performance is evaluated based on ROI. If this is the case, which div- ision would want to take over the new investment opportunity? b. If the company changed its performance evaluation criteria to encompass residual income based on a charge for capital of 14 per cent, which division would want to take over the new investment opportunity? 14.42 Divisional performance report * LO2 Coconut Plantations Pty Ltd is located on the Sunshine Coast in Queensland and manufactures sustainable coconut-based products for three different markets. The business has grown from a backyard hobby for the owner, Jo Geter, to quite a large manufacturing concern. The company is structured into three distinct divisions aligned with each market, as shown. Soaps Candles "Detergents Sales Contribution margin ratio Fixed costs Divisional investment $950 000 60% $180 000 $700 000 $570 000 50% $160 000 $250 000 $380 000 55% $120 000 $150 000 Common costs for the year totalled $300 000 and were allocated based on sales. Required Prepare a divisional performance report based on the information supplied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts