Question: please solve question no.2 Assignment 2 Taxation Q1. From the following particulars available for the previous year 2016-17, find out taxable income of different let

please solve question no.2

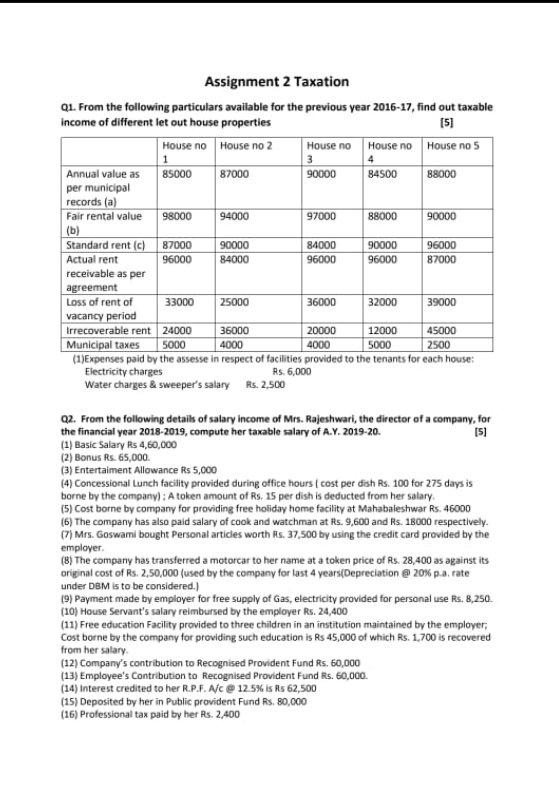

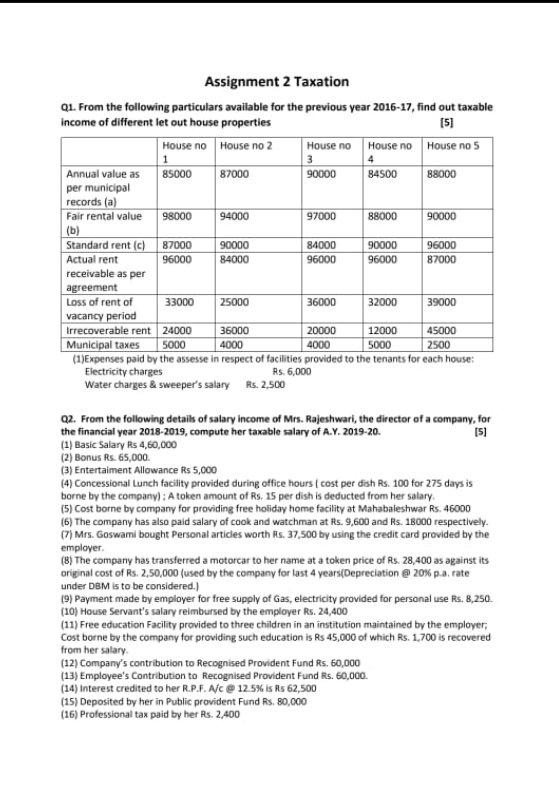

Assignment 2 Taxation Q1. From the following particulars available for the previous year 2016-17, find out taxable income of different let out house properties 151 House no House no 2 House no House no House no 5 3 4 Annual value as 85000 87000 90000 84500 88000 per municipal records (a) Fair rental value 98000 94000 97000 88000 90000 (b) Standard rent (c) 87000 90000 84000 90000 96000 Actual rent 96000 84000 96000 96000 87000 receivable as per agreement Loss of rent of 33000 25000 36000 32000 39000 vacancy period Irrecoverable rent 24000 36000 20000 12000 45000 Municipal taxes 5000 4000 4000 5000 2500 (1)Expenses paid by the assesse in respect of facilities provided to the tenants for each house: Electricity charges Rs. 6,000 Water charges & sweeper's salary Rs. 2,500 02. From the following details of salary income of Mrs. Rajeshwari, the director of a company, for the financial year 2018-2019, compute her taxable salary of A.Y. 2019-20. 151 (1) Basic Salary Rs 4,60,000 (2) Bonus Rs. 65,000 (3) Entertaiment Allowance Rs 5,000 (4) Concessional Lunch facility provided during office hours cost per dish Rs. 100 for 275 days is borne by the company); A token amount of Rs. 15 per dish is deducted from her salary (5) Cost borne by company for providing free holiday home facility at Mahabaleshwar Rs. 46000 (6) The company has also paid salary of cook and watchman at Rs. 9,600 and Rs. 18000 respectively. (7) Mrs. Goswami bought Personal articles worth Rs. 37,500 by using the credit card provided by the employer. (8) The company has transferred a motorcar to her name at a token price of Rs. 28,400 as against its original cost of Rs. 2,50,000 (used by the company for last 4 years(Depreciation @20% p.a. rate under DBM is to be considered.) 19) Payment made by employer for free supply of Gas, electricity provided for personal use Rs. 8,250 (10) House Servant's salary reimbursed by the employer Rs. 24,400 (11) Free education Facility provided to three children in an institution maintained by the employer, Cost borne by the company for providing such education is Rs 45,000 of which Rs. 1,700 is recovered from her salary (12) Company's contribution to recognised Provident Fund Rs. 60,000 (13) Employee's Contribution to recognised Provident Fund Rs. 60,000 (14) Interest credited to her R.P.F.C 12.5% is its 62,500 (15) Deposited by her in Public provident Fund Rs. 80,000 (16) Professional tax paid by her Rs. 2,400