Question: please solve quickly and i will give you like Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X

please solve quickly and i will give you like

please solve quickly and i will give you like

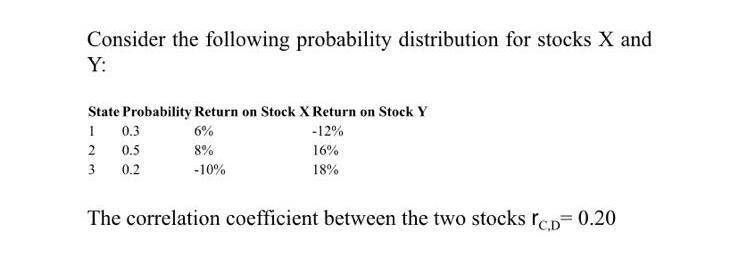

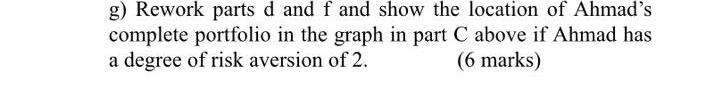

Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X Return on Stock Y 1 0.3 6% -12% 2 0.5 8% 16% 3 0.2 -10% 18% The correlation coefficient between the two stocks rop= 0.20 g) Rework parts d and f and show the location of Ahmad's complete portfolio in the graph in part C above if Ahmad has a degree of risk aversion of 2. (6 marks) Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X Return on Stock Y 1 0.3 6% -12% 2 0.5 8% 16% 3 0.2 -10% 18% The correlation coefficient between the two stocks rop= 0.20 g) Rework parts d and f and show the location of Ahmad's complete portfolio in the graph in part C above if Ahmad has a degree of risk aversion of 2. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts