Question: Please solve quickly and i will give you like Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X

Please solve quickly and i will give you like

Please solve quickly and i will give you like

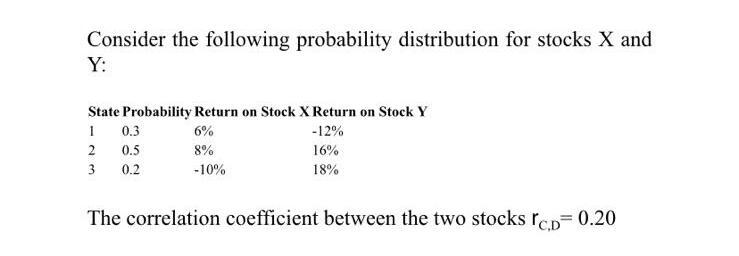

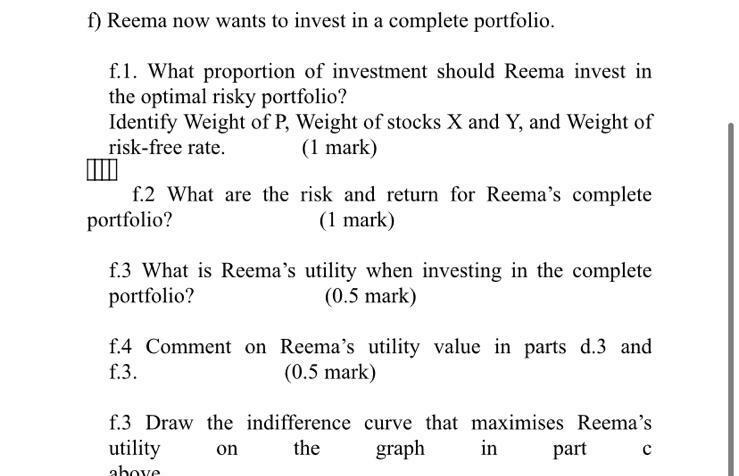

Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X Return on Stock Y 1 0.3 6% -12% 2 0.5 8% 16% 3 0.2 -10% 18% The correlation coefficient between the two stocks rop= 0.20 f) Reema now wants to invest in a complete portfolio. f.1. What proportion of investment should Reema invest in the optimal risky portfolio? Identify Weight of P, Weight of stocks X and Y, and Weight of risk-free rate. (1 mark) f.2 What are the risk and return for Reema's complete portfolio? (1 mark) f.3 What is Reema's utility when investing in the complete portfolio? (0.5 mark) f.4 Comment on Reema's utility value in parts d.3 and f.3. (0.5 mark) f.3 Draw the indifference curve that maximises Reema's utility on the graph in part above Consider the following probability distribution for stocks X and Y: State Probability Return on Stock X Return on Stock Y 1 0.3 6% -12% 2 0.5 8% 16% 3 0.2 -10% 18% The correlation coefficient between the two stocks rop= 0.20 f) Reema now wants to invest in a complete portfolio. f.1. What proportion of investment should Reema invest in the optimal risky portfolio? Identify Weight of P, Weight of stocks X and Y, and Weight of risk-free rate. (1 mark) f.2 What are the risk and return for Reema's complete portfolio? (1 mark) f.3 What is Reema's utility when investing in the complete portfolio? (0.5 mark) f.4 Comment on Reema's utility value in parts d.3 and f.3. (0.5 mark) f.3 Draw the indifference curve that maximises Reema's utility on the graph in part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts