Question: Please solve the following question using excel commands like solver, Analytic Solver, or sensitivity analysis. 4. Consider the Think-Big Development Co. problem presented in Section

Please solve the following question using excel commands like solver, Analytic Solver, or sensitivity analysis.

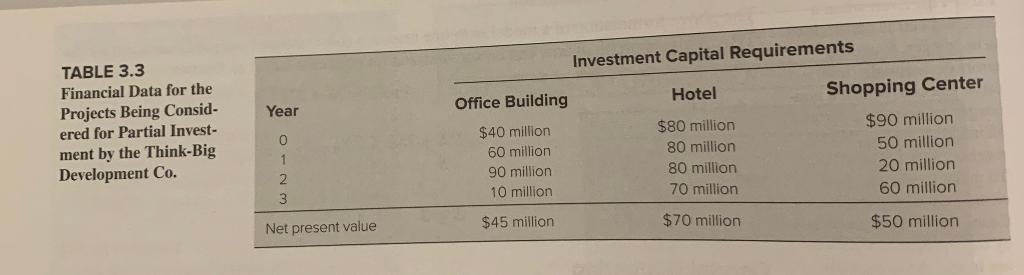

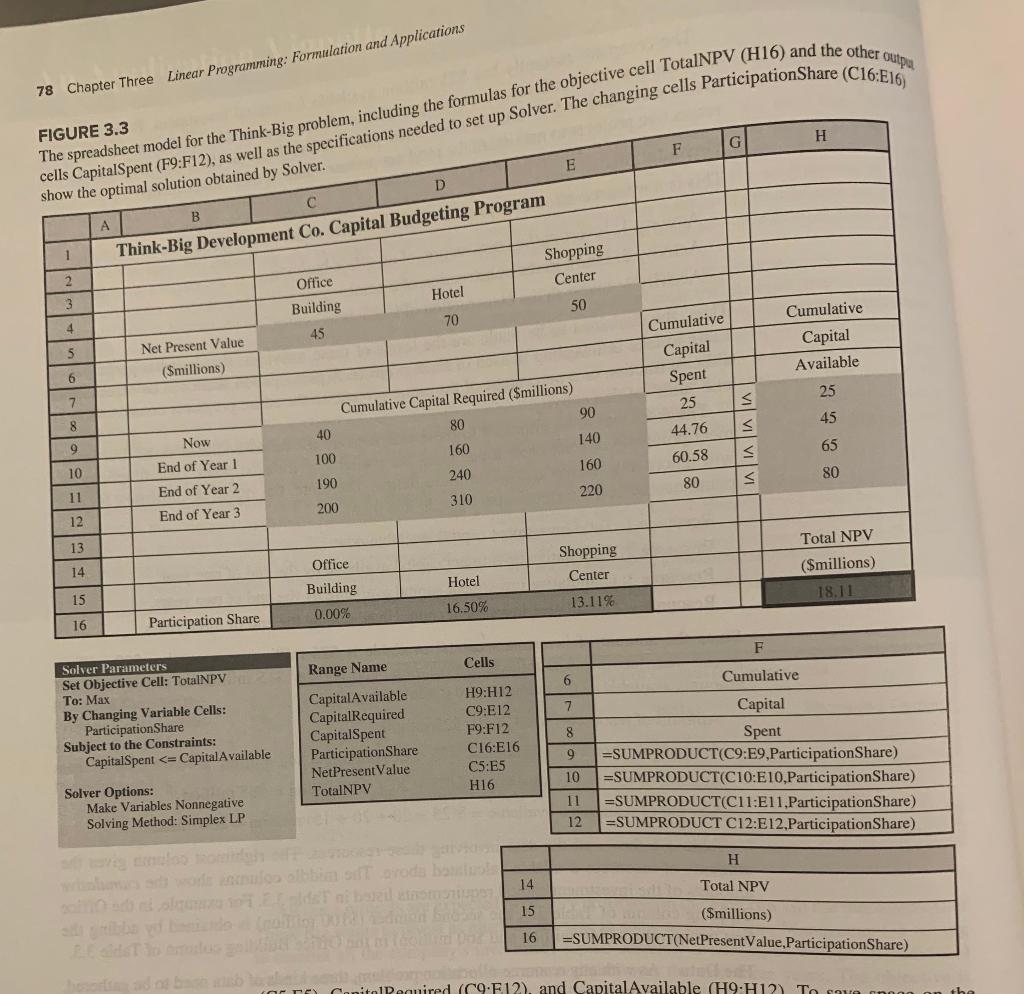

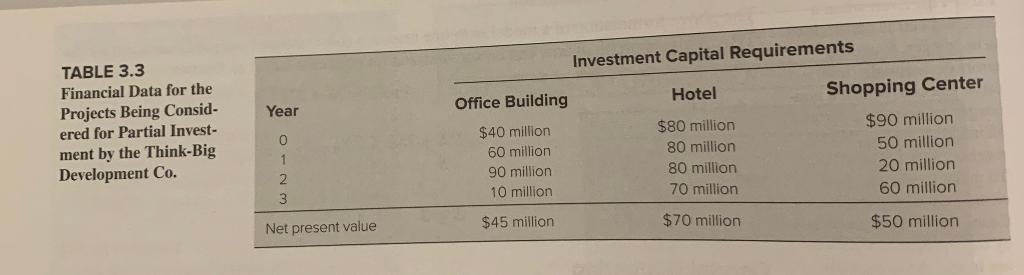

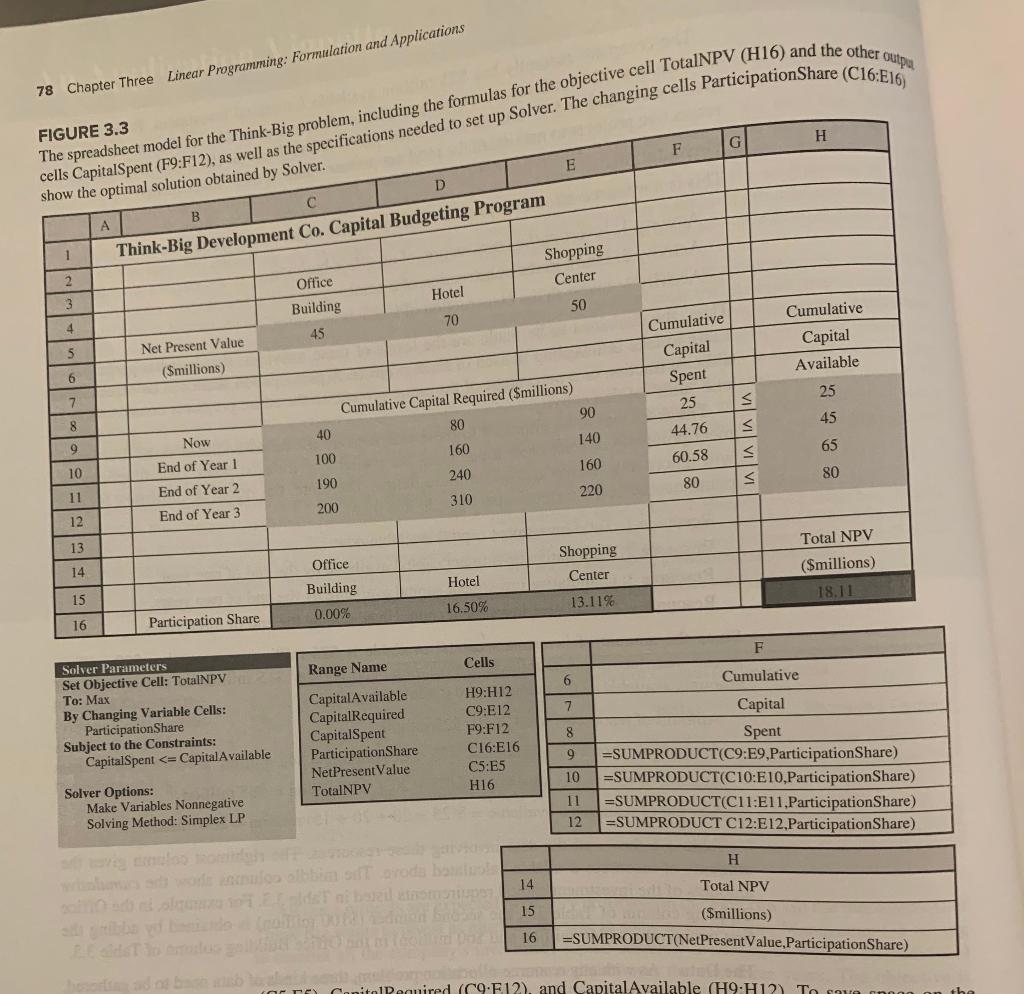

4. Consider the Think-Big Development Co. problem presented in Section 3.2, including the spreadsheet in Figure 3.3 showing its formulation and optimal solution. In parts a-g, use the spreadsheet and Solver to check whether the optimal solution would change and, if so, what the new optimal solution would be, if the estimates in Table 3.3 of the net present values of the projects were to be changed in each of the following ways. (Consider each part by itself.) a. The net present value of project 1 (a high-rise office building) increases by $200,000. b. The net present value of project 2 (a hotel) increases by $200,000. c. The net present value of project 1 decreases by $5 million. d. The net present value of project 3 (a shopping center) decreases by $200,000. e. All three changes in parts b, c, and d occur simultaneously. f. The net present values of projects 1, 2, and 3 change to $46 million, $69 million, and $49 million, respectively. g. The net present values of projects 1, 2, and 3 change to $54 million, $84 million, and $60 million, respectively. h. Use Solver to generate the sensitivity report for this problem. For each of the preceding parts, suppose that the change occurs later without having the spreadsheet model immediately available on a computer. Show in each case how the sensitivity report can be used to check whether the original optimal solution must still be optimal. i. For each of the three projects in turn, use a parameter analysis report to systematically generate the optimal solution and the total net present value when the only change is that the net present value of that project increases in $1 million increments from $5 million less than the current value up to $5 million more than the current value. Investment Capital Requirements Hotel Shopping Center Year Office Building TABLE 3.3 Financial Data for the Projects Being Consid- ered for partial Invest- ment by the Think-Big Development Co. 0 1 2 3 $40 million 60 million 90 million 10 million $80 million 80 million 80 million 70 million $90 million 50 million 20 million 60 million Net present value $45 million $70 million $50 million 78 Chapter Three Linear Programming: Formulation and Applications FIGURE 3.3 H G The spreadsheet model for the Think-Big problem, including the formulas for the objective cell TotalNPV (H16) and the other culpa cells CapitalSpent (F9:F12), as well as the specifications needed to set up Solver. The changing cells Participation Share (C16:16) F E D B show the optimal solution obtained by Solver. A Think-Big Development Co. Capital Budgeting Program 2 1 Shopping Center Office Hotel 3 Building 50 70 4 Cumulative Capital 45 5 Net Present Value (Smillions) Cumulative Capital Spent Available 6 25 7 25 45 8 40 Cumulative Capital Required (Smillions) 80 90 160 140 9 65