Question: please solve the following question wrtine by computer Evaluate the three choices that China faces in determining what to do with its currency value. Which

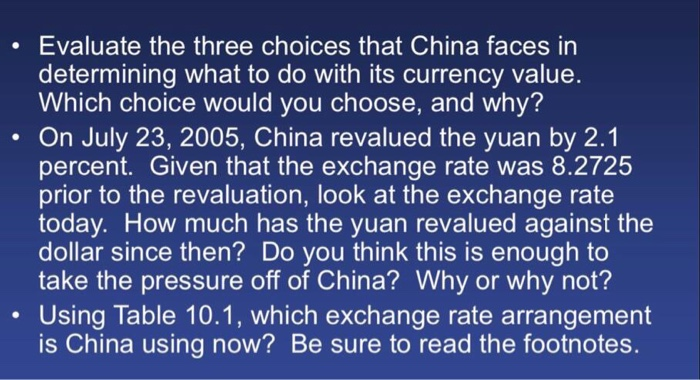

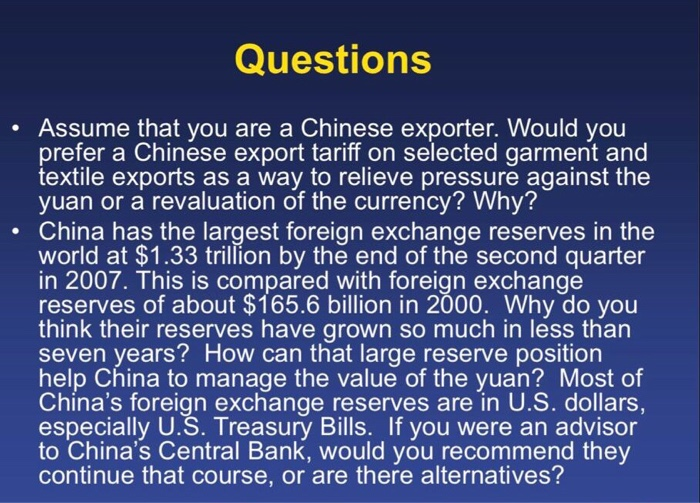

Evaluate the three choices that China faces in determining what to do with its currency value. Which choice would you choose, and why? On July 23, 2005, China revalued the yuan by 2.1 percent. Given that the exchange rate was 8.2725 prior to the revaluation, look at the exchange rate today. How much has the yuan revalued against the dollar since then? Do you think this is enough to take the pressure off of China? Why or why not? Using Table 10.1, which exchange rate arrangement is China using now? Be sure to read the footnotes. Questions Assume that you are a Chinese exporter. Would you prefer a Chinese export tariff on selected garment and textile exports as a way to relieve pressure against the yuan or a revaluation of the currency? Why? China has the largest foreign exchange reserves in the world at $1.33 trillion by the end of the second quarter in 2007. This is compared with foreign exchange reserves of about $165.6 billion in 2000. Why do you think their reserves have grown so much in less than seven years? How can that large reserve position help China to manage the value of the yuan? Most of China's foreign exchange reserves are in U.S. dollars, especially U.S. Treasury Bills. If you were an advisor to China's Central Bank, would you recommend they continue that course, or are there alternatives? Orare uld yoyou want us Most Evaluate the three choices that China faces in determining what to do with its currency value. Which choice would you choose, and why? On July 23, 2005, China revalued the yuan by 2.1 percent. Given that the exchange rate was 8.2725 prior to the revaluation, look at the exchange rate today. How much has the yuan revalued against the dollar since then? Do you think this is enough to take the pressure off of China? Why or why not? Using Table 10.1, which exchange rate arrangement is China using now? Be sure to read the footnotes. Questions Assume that you are a Chinese exporter. Would you prefer a Chinese export tariff on selected garment and textile exports as a way to relieve pressure against the yuan or a revaluation of the currency? Why? China has the largest foreign exchange reserves in the world at $1.33 trillion by the end of the second quarter in 2007. This is compared with foreign exchange reserves of about $165.6 billion in 2000. Why do you think their reserves have grown so much in less than seven years? How can that large reserve position help China to manage the value of the yuan? Most of China's foreign exchange reserves are in U.S. dollars, especially U.S. Treasury Bills. If you were an advisor to China's Central Bank, would you recommend they continue that course, or are there alternatives? Orare uld yoyou want us Most

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts