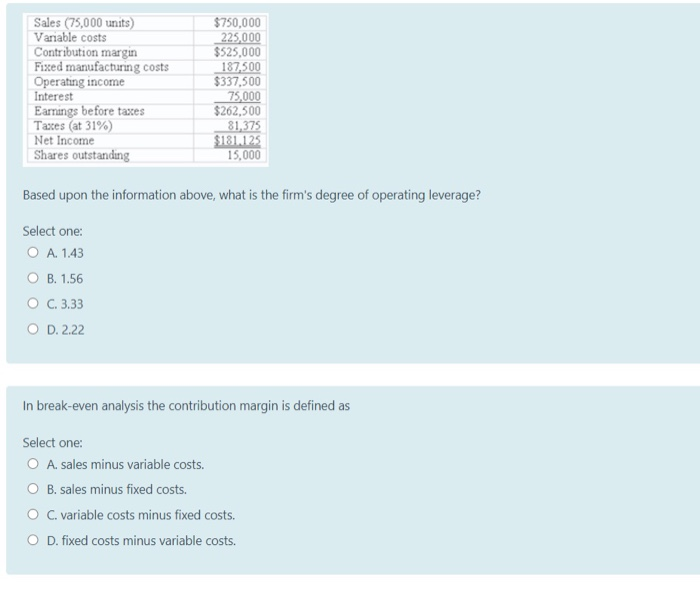

Question: Sales (75,000 units) Variable costs Contribution margin Fixed manufacturing costs Operating income Interest Earnings before taxes Tastes (at 31%) Net Income Shares outstanding $750,000 225,000

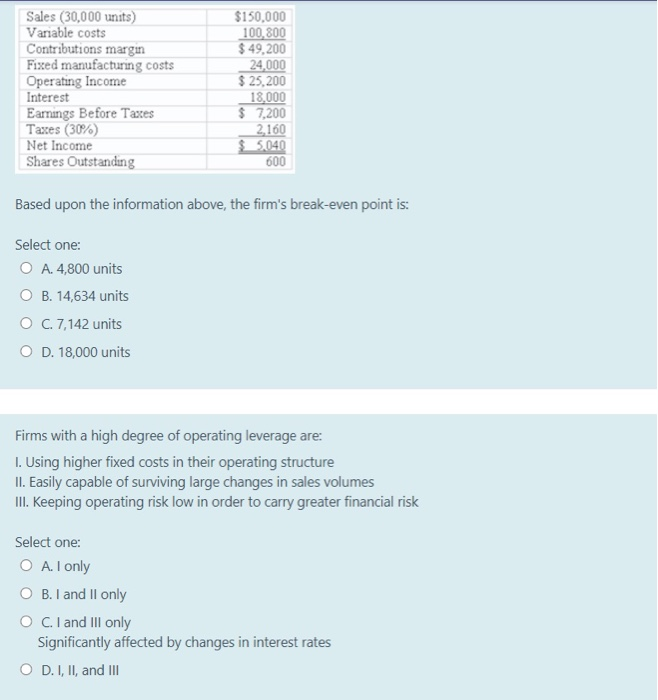

Sales (75,000 units) Variable costs Contribution margin Fixed manufacturing costs Operating income Interest Earnings before taxes Tastes (at 31%) Net Income Shares outstanding $750,000 225,000 $S25,000 187,500 $337,500 75,000 $262,500 81,375 $181.125 15,000 Based upon the information above, what is the firm's degree of operating leverage? Select one: O A 1.43 OB. 1.56 O C.3.33 O D.2.22 In break-even analysis the contribution margin is defined as Select one: O A. sales minus variable costs. O B. sales minus fixed costs. O C. variable costs minus fixed costs. O D. fixed costs minus variable costs. Sales (30,000 units) Variable costs Contributions margin Fixed manufacturing costs Operating Income Interest Earnings Before Tastes Taxes (30%) Net Income Shares Outstanding $150,000 100,800 $ 49,200 24,000 $ 25,200 18,000 $ 7,200 2,160 5.040 600 Based upon the information above, the firm's break-even point is: Select one: O A. 4,800 units OB. 14,634 units O C. 7,142 units O D. 18,000 units Firms with a high degree of operating leverage are: 1. Using higher fixed costs in their operating structure II. Easily capable of surviving large changes in sales volumes III. Keeping operating risk low in order to carry greater financial risk Select one: O A. I only O B. I and II only O C. I and III only Significantly affected by changes in interest rates O D.I, II, and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts