Question: please solve the hand written solution and explain step by step, thank you! Assets, Inc., plans to issue $6 million of bonds with a coupon

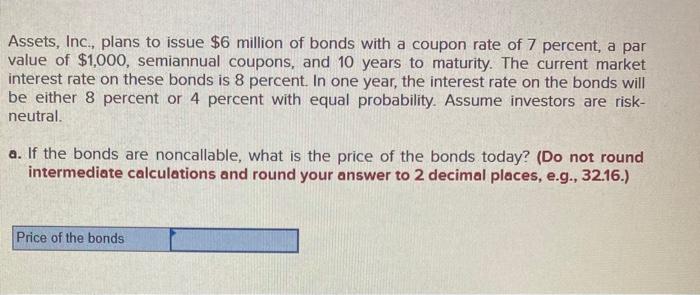

Assets, Inc., plans to issue $6 million of bonds with a coupon rate of 7 percent, a par value of $1,000, semiannual coupons, and 10 years to maturity. The current market interest rate on these bonds is 8 percent. In one year, the interest rate on the bonds will be either 8 percent or 4 percent with equal probability. Assume investors are risk- neutral. a. If the bonds are noncallable, what is the price of the bonds today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price of the bonds b. If the bonds are callable one year from today at $1,050, will their price be greater or less than the price you computed in part (a)? O Lesser O Greater

Step by Step Solution

There are 3 Steps involved in it

To solve the problem we first calculate the price of the bonds today assuming they are noncallable a... View full answer

Get step-by-step solutions from verified subject matter experts