Question: Please solve the problem in the picture (if possible, I would appreciate it if you could also solve this one problem I entered).Thanks you You

Please solve the problem in the picture (if possible, I would appreciate it if you could also solve this one problem I entered).Thanks you

You are evaluating two investment alternatives. One is a passive market portfolio with an expected return of 10% and a standard deviation of 16%. The other is a fund that is actively managed by your broker. This fund has an expected return of 15% and a standard deviation of 20%. The risk-free rate is currently 7%. Answer the questions below based on this information.

1) How would it affect the graph if the broker were to charge the full amount of the fee?

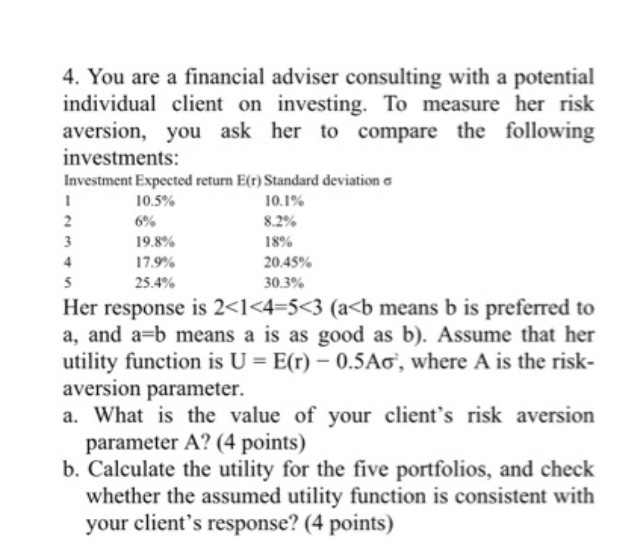

8.2% 4. You are a financial adviser consulting with a potential individual client on investing. To measure her risk aversion, you ask her to compare the following investments: Investment Expected return E(r) Standard deviation 10.5% 10.1% 6% 19.8% 18% 17.9% 20.45% 25.4% 30.3% Her response is 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock