Question: please solve the question below using excel or the formulas below with an finance calculator thank you A stock has an expected return of 13.78%

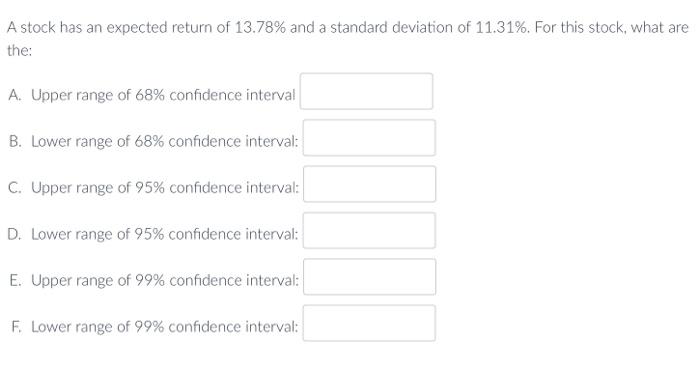

A stock has an expected return of 13.78% and a standard deviation of 11.31%. For this stock, what are the: A. Upper range of 68% confidence interval B. Lower range of 68% confidence interval: C. Upper range of 95% confidence interval: D. Lower range of 95% confidence interval: E. Upper range of 99% confidence interval: F. Lower range of 99% confidence interval: If you want to use formulas, listed below are some formulas for commonly used Statistics: 1) The Average (or expected value) of data x1,x2,x3,xn is given by: Average==n1i=1nxi 2) The Variance of data x1,x2,x3,,xn is given by: Var=2=n11i=1n(xi)2 Note: the above formula represents a sample from a population. If the whole population is sampled, then the we use n instead of (n-1). The difference is subtle. Uniess otherwise stated, use the formula for a sample from a population 3) The standard deviation is the square root of the Variance. 4) The geometric avarage retum is calculated as: GeomAvg(RA)=i=1n(1+Ri)1=[(1+R1)(1+R2)(1+Rn)]1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts