Question: Please solve the question in Python Jupyter notebook and show all the codes. Task 2: MC Simulation & European Option Pricing In lab session 4

Please solve the question in Python Jupyter notebook and show all the codes.

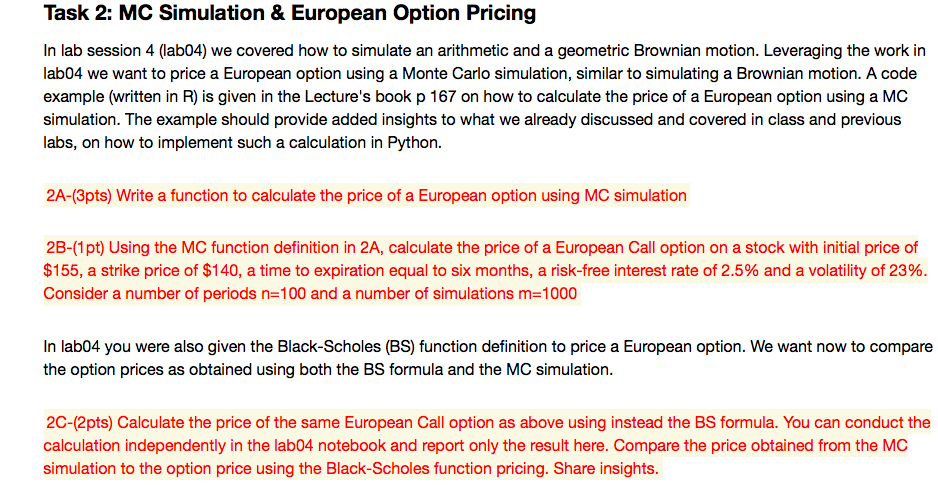

Task 2: MC Simulation & European Option Pricing In lab session 4 (lab04) we covered how to simulate an arithmetic and a geometric Brownian motion. Leveraging the work in lab04 we want to price a European option using a Monte Carlo simulation, similar to simulating a Brownian motion. A code example (written in R) is given in the Lecture's book p 167 on how to calculate the price of a European option using a MC simulation. The example should provide added insights to what we already discussed and covered in class and previous labs, on how to implement such a calculation in Python. 2A-(3pts) Write a function to calculate the price of a European option using MC simulation 2B-(1 pt) Using the MC function definition in 2A, calculate the price of a European Call option on a stock with initial price of $155, a strike price of $140, a time to expiration equal to six months, a risk-free interest rate of 2.5% and a volatility of 23%. Consider a number of periods n=100 and a number of simulations m=1000 In lab04 you were also given the Black-Scholes (BS) function definition to price a European option. We want now to compare the option prices as obtained using both the BS formula and the MC simulation. 20-(2pts) Calculate the price of the same European Call option as above using instead the BS formula. You can conduct the calculation independently in the lab04 notebook and report only the result here. Compare the price obtained from the MC simulation to the option price using the Black-Scholes function pricing. Share insights. Task 2: MC Simulation & European Option Pricing In lab session 4 (lab04) we covered how to simulate an arithmetic and a geometric Brownian motion. Leveraging the work in lab04 we want to price a European option using a Monte Carlo simulation, similar to simulating a Brownian motion. A code example (written in R) is given in the Lecture's book p 167 on how to calculate the price of a European option using a MC simulation. The example should provide added insights to what we already discussed and covered in class and previous labs, on how to implement such a calculation in Python. 2A-(3pts) Write a function to calculate the price of a European option using MC simulation 2B-(1 pt) Using the MC function definition in 2A, calculate the price of a European Call option on a stock with initial price of $155, a strike price of $140, a time to expiration equal to six months, a risk-free interest rate of 2.5% and a volatility of 23%. Consider a number of periods n=100 and a number of simulations m=1000 In lab04 you were also given the Black-Scholes (BS) function definition to price a European option. We want now to compare the option prices as obtained using both the BS formula and the MC simulation. 20-(2pts) Calculate the price of the same European Call option as above using instead the BS formula. You can conduct the calculation independently in the lab04 notebook and report only the result here. Compare the price obtained from the MC simulation to the option price using the Black-Scholes function pricing. Share insights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts