Question: PLEASE SOLVE THESE QUESTONS WTH CORRECT WAYS, THANKS! QUESTION 1. NEMA Industries Inc. has issued a 4-year maturity, 16% coupon bonds with a total nominal

PLEASE SOLVE THESE QUESTONS WTH CORRECT WAYS, THANKS!

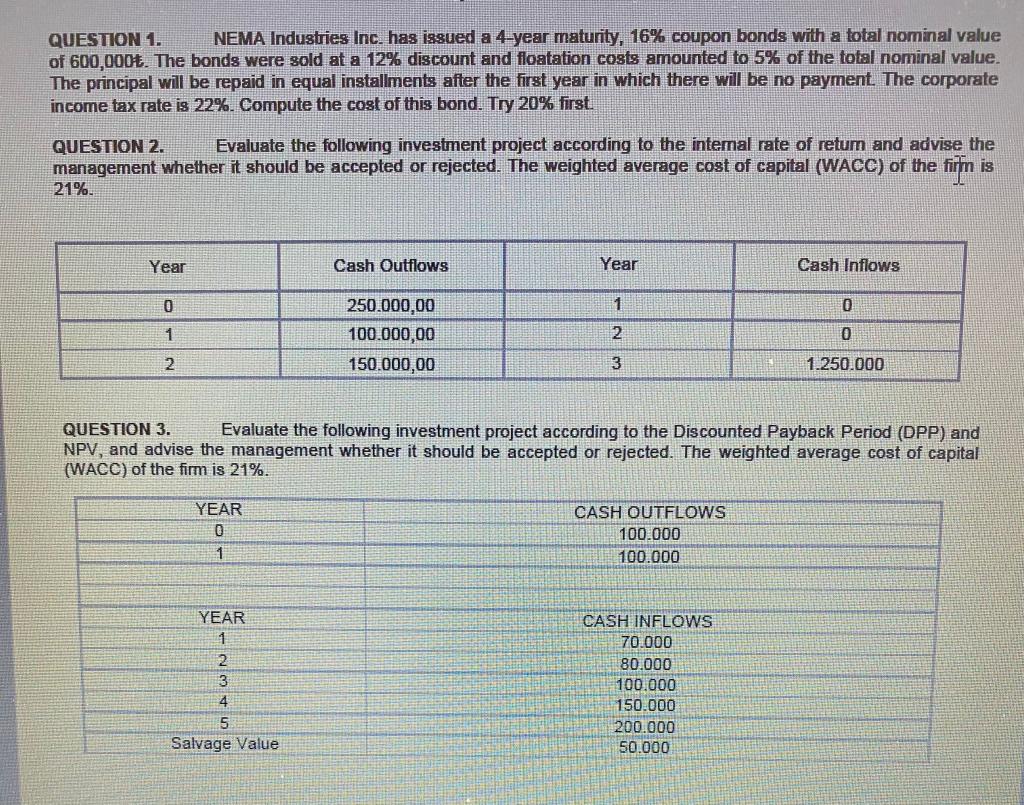

QUESTION 1. NEMA Industries Inc. has issued a 4-year maturity, 16% coupon bonds with a total nominal value of 600,000+. The bonds were sold at a 12% discount and floatation costs amounted to 5% of the total nominal value. The principal will be repaid in equal installments after the first year in which there will be no payment. The corporate income tax rate is 22%. Compute the cost of this bond. Try 20% first. QUESTION 2. Evaluate the following investment project according to the internal rate of retum and advise the management whether it should be accepted or rejected. The weighted average cost of capital (WACC) of the firm is 21%. Year Cash Outflows Year Cash Inflows 0 1 0 1 250.000,00 100.000,00 150.000,00 2 0 2 3 1.250.000 QUESTION 3. Evaluate the following investment project according to the Discounted Payback Period (DPP) and NPV, and advise the management whether it should be accepted or rejected. The weighted average cost of capital (WACC) of the firm is 21%. YEAR 0 CASH OUTFLOWS 100.000 100.000 1 YEAR 1 2 3 4 CASH INFLOWS 70.000 80.000 100.000 150.000 200.000 50.000 5 Salvage Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts